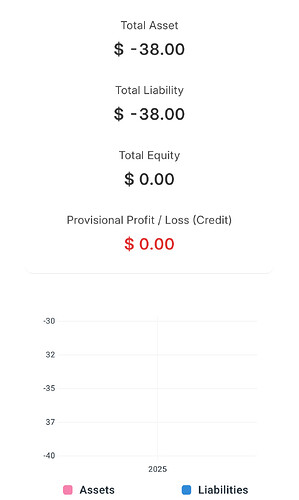

I must of done something wrong since balance sheet is in negative also.

I’ve always run Credit Cards as current liability accounts, but I’ve seen people do it both ways. I’m definitely not an accountant, though!

You’re missing half of the transaction here. If you’re using a credit card to pay off a creditor, the debt you have to that accreditor needs to accrue first. That would typically happen with a purchase invoice.

If you’re not sure what that means, we can explain further if you clarify your process a bit more. Did you create the transaction you’re showing with a Payment Entry?

Yes payment entry. I don’t issue invoices or POs. Need to record a simple transaction of incoming sale or deposit of cash for sale, then for some items subsequent purchase of cost of goods to sell, on my cc. Weeks later I pay off the cc from bank account balance.

I should also mention, I have 3 cost centers, income can come from all, likewise expense.

A Payment Entry document is part of a payables/receivables cycle. If all of your transactions are concluded at point of sale, you won’t ever use it.

It sounds like you want to be using Purchase Invoices and Sales Invoices. Even if you don’t issue those documents, they’re the transaction you’re trying to represent. Both Purchase and Sales Invoices have a “Include Payment” field, which you can just tick by default if you’d like.

(All that said, it might be worth thinking about whether you really need ERPNext. It’s not simple software, and there are friendlier options if all you need is cash-basis accounting. Not trying to scare you away, and you’re definitely welcome here whatever the size of your business. This is a phenomenal platform, but expect a learning curve!)

Hmm, OK, I tried that, but they require me to enter and save items, uom. Dont need inventory or item tracking. Anyway to do it without that?

Items are basically templates for invoices. You can use them, or you can just enter item details in directly. If you don’t want to deal with individual items, you can just use a single item called “Purchased Items”.

For things like UoM, if you don’t care about the value, you can just set it by default to “Qty” or whatever you like. UoM tends not to be very important for non-stock items.

Got it. I’m gonna give it a try and see if I can make it work for me. Only issue I have now is the CC account is showing a $1 surplus after making a sale for 39 and a cc charge to supplier for 38. Shouldn’t my bank account have that $1 surplus?

Oh, one more thing, the reason I want to use erpnext is cost centers. All the other financial tools I’ve found that work on cash basis sales, don’t do something like cost centers. But the issue is looking at the P&L, I can’t find a way to show cost centers in the P&L for comparison. I’d like a general P&L that shows the company as a whole, but like maybe cost center across the top where year is right now. I can’t find a way to add that column.

I’m not really following. Was the sale made to your credit card account or somewhere else? ERPNext won’t move money between your bank account and your credit card unless you tell it to (probably with a journal entry).

I must of done something wrong the first time when I made the sales invoice, in making a payment selecting the wrong to account. It worked, but now the CC has a balance:

Do I just do an internal transfer now from bank to CC to pay it off in the system?

That depends on how/when you pay off your credit card balance. But, generally, yes. Crediting a deposit account and debiting your credit card would be a common way to do that.

All the other financial tools I’ve found that work on cash basis sales

ERPNext does not offer any cash basis reporting.

But the issue is looking at the P&L, I can’t find a way to show cost centers in the P&L for comparison. I’d like a general P&L that shows the company as a whole, but like maybe cost center across the top where year is right now. I can’t find a way to add that column.

This doesn’t exist out of the box but should. And it wouldn’t be on a cash basis.

If you don’t need to manage inventory, you don’t need ERPNext and should use QB. If you do need inventory, you should be keeping accrual books. I promise that your current approach will be frustrating, inaccurate or both.

I’m told there are things you can do to use ERPNext in a cash basis:

- Use Sales Orders to request payment, then create Sales Invoice when paid.

- Don’t maintain inventory on all items (if you wish) and use a “Purchases Expense” account when purchasing items. Again Create Purchase Invoice When Paying.

This creates the scenario where cash is equivalent to accrual, but it’s forcing an accrual bookkeeping system into a specific shape solely for the purposes of reporting. You can claim that that “works”, I will argue that that it’s materially incorrect.

A more comprehensive solution would be to write cash basis reports. There is currently no direct connection from the allocation field on the Payment Entry Reference to the amount and account fields on a Purchase Invoice Item or Sales Invoice Item.

I agree with creating Cash Basis reports. If we ignore Cash Basis businesses, many will miss out on all the glory. Perhaps a custom module will also be helpful.

The overlap of “cash based businesses” and “those with inventory requirements” is vanishingly small. There has to be enough enterprise to justify the hassle of an ERP. A custom module is a reasonable approach, but the fact that it isn’t being asked for demonstrates the actual demand.

I helped some friends set up ERPNext for cash-basis accounting at their organization. Generally, I agree it’s not worth the effort, but they had other process controls that were complicated enough to benefit from Frappe.

I’m definitely no accountant, and I don’t know if what they did was materially correct or incorrect, but their needs were simple enough that I’m not sure it matters.

All that said, @jfreak53, I’ll reiterate what I said above, which is that I’m skeptical ERPNext will be a good fit for you. It appears from this thread that you’re still new to double entry accounting, which is great, but ERPNext assumes a good understanding. It won’t stop you from making mistakes the way quickbooks will, and I’d say there’s a good chance you realize a year from now that you’ve entered everything incorrectly.

Thanks! Really the only thing missing for me, forget cash basis, I’ve figured a work around, is the ability to show cost centers in P&L. If I can get that to work it’ll be great!