i am creating the purchase invoice but i get the error ‘Credit To account must be a Balance Sheet account’

Please help me with some direction to get out of the trouble

i am creating the purchase invoice but i get the error ‘Credit To account must be a Balance Sheet account’

Please help me with some direction to get out of the trouble

This error message could stand to be improved:

Change the “Balance Must Be” field on your Accounts Payable account(s) to “Credit”.

If this works for you (and it should), please raise an issue on Github regarding it, including your suggestion for wording. ← this is giving back to the community, it’s easy and you should do it for karma’s sake.

Which account is selected for “Credit To” field? As error message suggested, it must be a Balance Sheet account, means the account must be either Asset or Liability account.

The validation is based on “Report Type” property. Please check what is the value of “report type” for the account.

thanks for the reply

problem is solved

Could you please post Screencast with changes you done to get rid of error for everyone benefit?

“Report Type” is the field triggering the error. @nabinhait is right, you are likely trying to post to an income or expense (Profit and Loss) account when it should be an asset, liability or equity (Balance Sheet) account.

It’s not so much an “error to get rid of” as it is understanding the accounting rules behind the error message. What does your transaction look like?

I am struggling with exactly the same problem

@wolfdokha how did you solve this problem?

@tmatteson @nabinhait why must all payments to a supplier/creditor have an asset or liability account? Most payments of a company concern the profit and loss accounts!

In accounting, Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket-Debit, and liabilities take money out- Credit

In accounting you have balance sheet and profit & loss accounts. Not evey expenditure results as liability in the balance sheet! How do you book your gas station bill for a company car? What about telecom bills for telecommunication (not appliances), restaurant bills?

Expense goes to an income statement account. Payable expense is a liability account that is reported on the balance sheet.

Hope this will help.

I would like to create a purchase invoice for a company car road toll which is payed on a yearly basis. This I have done online via creditcard, and therefore I got an electronical invoice from the supplier.

Now I would like to create a purchase invoice with credit to accout ‘7240 Company Car Expenditures’ (this account is an income statement account).

But this is rejected => ’ Please ensure Credit To account is a Balance Sheet account. You can change the parent account to a Balance Sheet account or select a different account.’

— Expense purchase

7240 Company Car Expenditures — Debit.

Party Name -Accrued Liability — Credit

-----When paid

Party Name -Accrued Liability Account - Debit

Cash/ Bank Account - Credit

Hope it will help…

What do you mean with ‘Expense purchase’?

Creating purchase invoice is not working, because of the given message!

Should I start with a purchase order?

Furthermore, what is your recommendation to book restaurant bills in erpnext?

Thank you in advance!

Today I spoke with two accountants!

The right procedure for creating a purchase invoice is, regarding to the example with the car road toll:

Account ‘Company Car Expenditures (Expense Account)’ - Creditor / Supplier

Paying the purchase invoice is:

Creditor / Supplier - Bank/Cash/Creditcard

Creating a purchase invoice in Erpnext prevents this and stop saving the record with the message:

’ Please ensure Credit To account is a Balance Sheet account. You can change the parent account to a Balance Sheet account or select a different account.’

But a balance sheet account is not the right way, because you can never track all those different expenses, which are organized in Expense Accounts, of course located in the Income Statement.

…it must be an Expense Account!

What to do?

ERPNext uses item-based accounting - an item can be either an object or a service. Whereas an object is a stock item that shows up on the Balance Sheet as say inventory, a service is a non-stock item that shows up on the Income/Expense Statement.

Discussions like this may help How to enter purchases other than stock item like stationary?

Basically this would be a nice approach. But what are you doing with merchandise goods?

In this case this approuch would be differ from from the accounting standards (Europe).

Merchandise goods (within one accounting periode) are treated in the income statement.

…so it must be booked to an expense account for merchandise goods in the income statement and not to an account in the balance sheet! Only assets, which belongs to the needs of a company, are booked to an asset account in the balance sheet!

Assuming my assertion is correct, this would be a show stopper for ERPNext in Europe.

Correct, unsold merchandise appears on the Balance Sheet as an asset in inventory.

When it is removed from inventory and sold, it shows up on the Income Statement.

So it means that you can’t comply with accounting standards using ERPNext in an European midsized company!

Why is it necessary to check if it is an balance sheet account on this position? What could be, when I’am deactivating this check in the code (of course only for testing purposes)? Will this have any impact on the subsequent process?

I gave them already a try, but then I stepped into the next trap! Missing field Cost Center in purchase invoice form - #3 by Perino

The check will be bypassed, but the purchase invoice form still can’t be saved, because of the next warning that the related cost center is missing, stops the process.

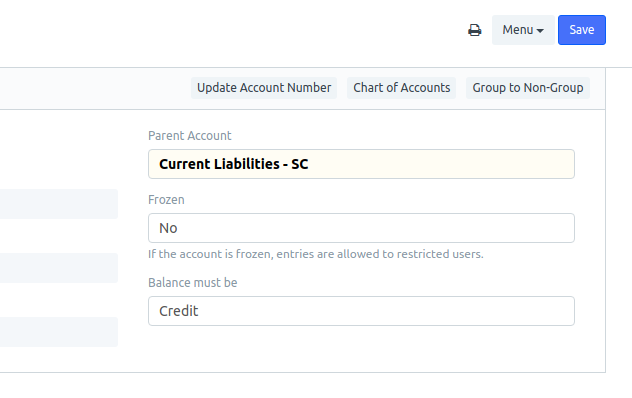

Just in case anyone bumps with this problem in the future, the area to check the account you are using is in Purchasing Invoice at the end almost above comments. Here an image:

Have a great one!

PS: I struggled finding this one so thought this might help.

Update to recent Ver 13 and ver 14 changed behavior where a Purchase Invoice Items cannot point to asset account like inventory. How to return behavior to previous scenarios. We have a few circumstances where we have no interest in doing purchase receipt and on 1 purchase invoice have both expense and asset items. In theory we could create those asset items as stock items and use the update stock check box and assign them to a warehouse. But that is a lot more steps to replicate what we do now with no issue just to get $ into an inventory account from Purchase Invoice.

Alternatively if we could use an asset account in item definition of Income and Expense accounts that would work, but it is not allowed.