Hello ERPNext Community,

We are a small full-service media agency with branches in Germany and Austria. Currently we are dogfooding ERPNext. As a service company that purchases quite a lot of services from cloud, domain, or software vendors, and sometimes specialized hardware, we are dealing with quite a lot of unique purchase invoice items.

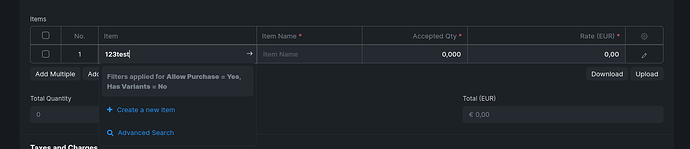

Now, we noticed an issue that when we get a purchase invoice it is quite time-consuming and cumbersome for us to enter each unique item (for example in an invoice from our domain registrar - first year for example.com, first year for example.de etc.). They all have different prices, and those prices often vary year over year, and therefore we also cannot use the subscription feature of ERPNext, at least not over the initial period.

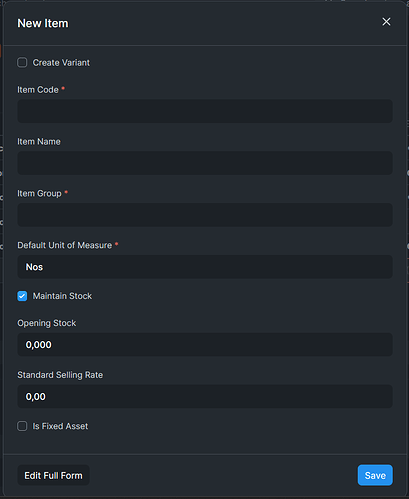

The main issue we have is that for each item, we have to create it in the “New Item” popup and deselect the “Keep Stock” checkbox, and also enter both a name and a code, when in many cases in our region and line of business, items from suppliers do not have a code. This is obviously not optimal. I am talking about this popup:

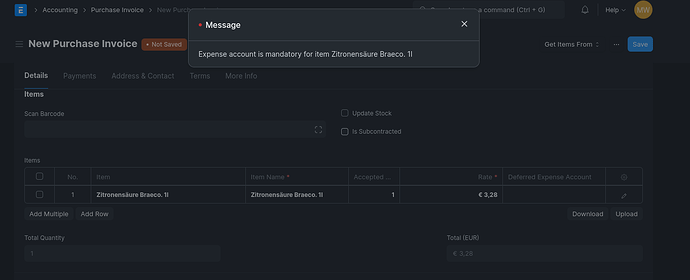

Or we do it using the “edit” popup (the pencil icon, I can’t show it here as I can only post one picture as a new user). This also (seems to) work, but in that case the UOM and of course the item name need to be specified manually. Also (but perhaps due to a customization), in our production environment we get a Python error “AttributeError: ‘NoneType’ object has no attribute ‘name’” if we do that and the invoice save operation is rejected (" —

The resource you are looking for is not available").

What is the most effective solution, starting from the default Frappe Cloud ERPNext settings, to achieve a “copy-paste” or “tab-type-tab-type” solution for entering purchase invoice items? One account in the books per invoice and one stock-or-non-stock checkbox per invoice would be sufficient.

We are very happy with the sales invoice functionality btw, as there we define the items and variants, pricing policies etc., so there we need that level of control.

At the moment we do not have to do double-entry accounting, but we would like to be able to hit the ground running with that once we have to, so this would need to work as well.

I hope you can help us. Thank you in advance and thanks to the dev team for this impressive piece of software!