I have done some research/testing/experimenting in my dev instance to see about figuring out some things.

So I have not been able to figure out all the varying operators/operations you can do in a salary structure component formula, I did figure out that you can use any field name from the document type itself. If you need more fields from the employee, you can add read-only versions of those into the salary slip form via link records and then use those field names in your formulas.

So for example, in US there is a thing known as “tax allowances” and “tax additional” that you can do your federal government taxes. These are employee specific, so I created them in my employee document type

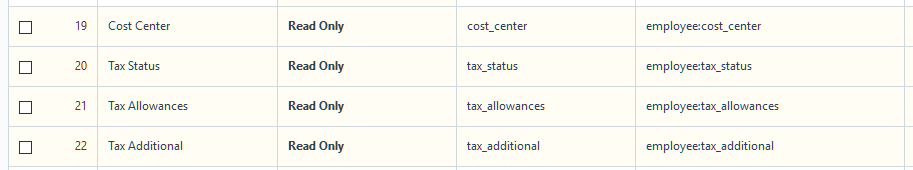

I then linked these fields to the salary slip document type with read-only fields

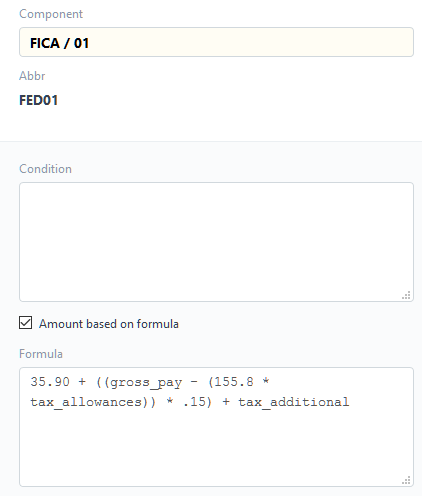

Then I use these fields in the formula for the federal tax salary component on a salary structure record

So what I am personally missing is 3 things:

-

The ability to know what the current Fiscal YTD gross earnings is for a specific employee. Some of the taxes we pay are based on salary maxes, so I would like to be able to use this in the condition field. E.g. if ytd_gross_pay <= 7000 then apply formula.

-

The ability to be able to have some kind of IF() or SELECT() type function. The above mentioned federal tax has some ranges that are standard based on gross period wages. The first “magic number” of $35.90 and .15 are based on one of the ranges in a tax table. I would like to have a CASE() or SELECT() type formula/function that I can then use to set some variables and use them in the formula. Or maybe use that in condition section to set the variables for use in the formula

-

The ability to list employer paid taxes and expenses that are not deducted from the employee’s payslip (and are not even shown on the printed version unless we want to)

Hope this helps!