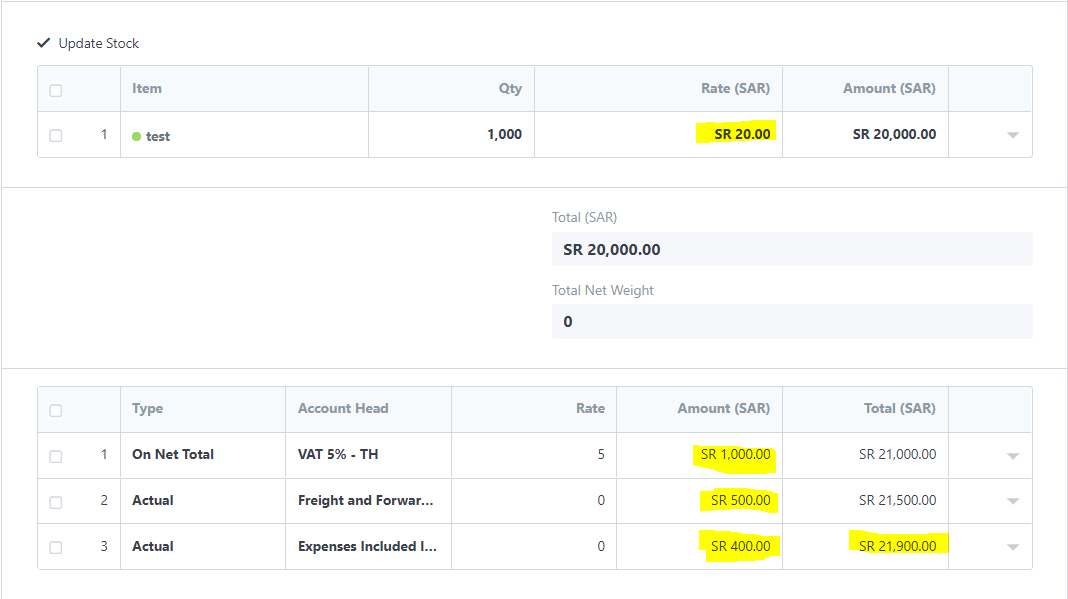

here I manually added the rows of the p.inv expenses and taxes (P.inv 00100)

20,000+1,000+500+400/1,000(qty) = 21.9SAR (gross unit cost)… and that number never showed in my reports… only the exactly item purchasing rate showed there (20SAR), which is very very problematic…

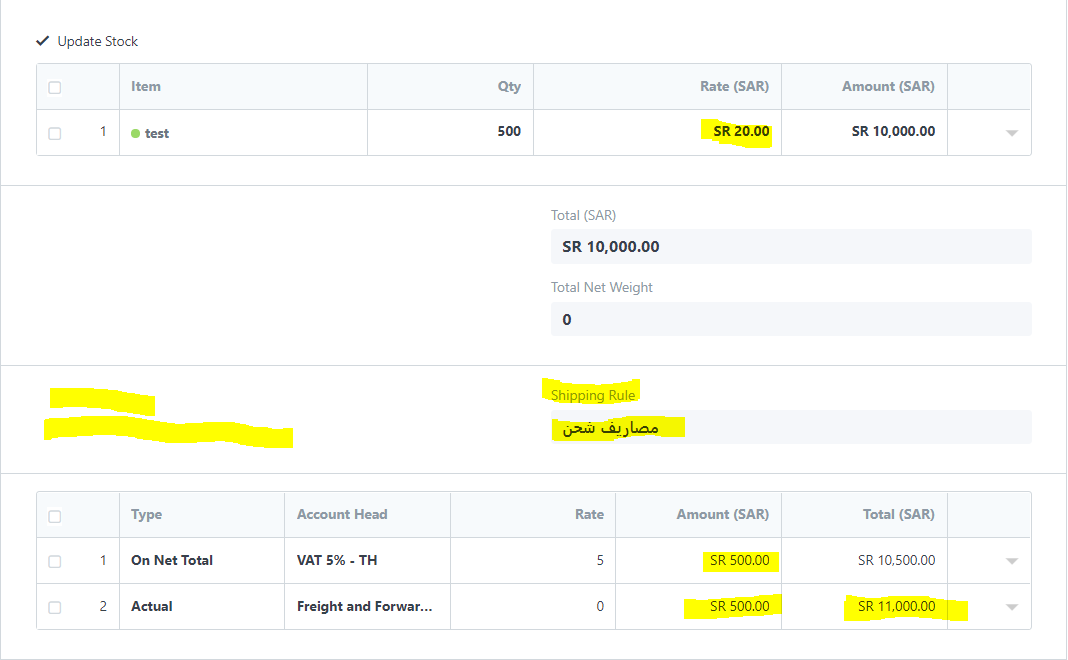

and here I only chose the predefined template, and it automatically added the rows for me (P.inv 00105)

500+500+1,000/500 (qty) = 22SAR (Per unit)… and that was exactly what appeared in the SL

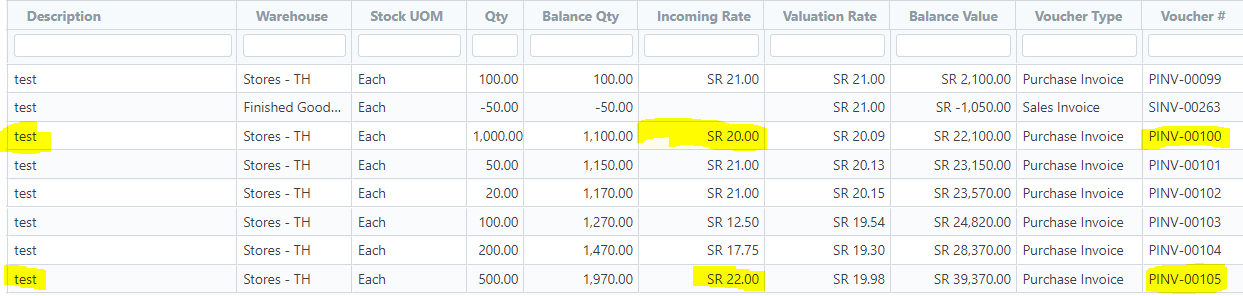

here’s the stock ledger ![]()