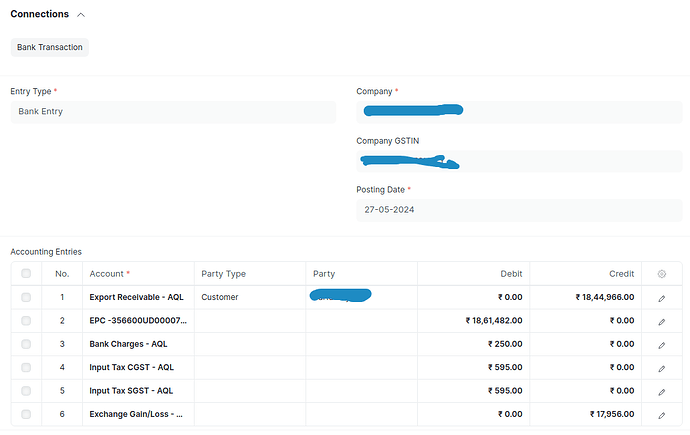

In above entry it is multi currency transaction

GST calculated manually on EPC (Bank OD account of type ‘Bank’ under liability) and on bank charges(GST 18%)

From EPC account GST there is following rule:

0-1,00,000 (0.10% gst)

1,00,001- 10,00,000 (0.09% gst)

remaining balance (0.0.18% gst)

GST added to the JV will not reflect to the GSTR 3B report. please let me know how to do such entries. because to the export business this is frequent Use case.

Hi,

There is no one single form from which this can be booked directly.

You should ideally split this entry in 2 parts

- Bank charges: booked through purchase invoice

- Amount received from customer: booked through journal entry or payment entry

Bank charges should be booked through Purchase Invoice.

How to compute bank charges?

Bank charges are in two parts: Pure bank charges (Rs 250) and charges for currency exchange (not explicitly specified but calculated as per formula given by you)

Compute net amount received from customer

This is after adjustment of bank charges. Exchange gain or loss should be booked accordingly.

Why is all this not covered in one transaction? Why is just a journal entry not supported?

Covering all aspects of GST / Bank Charges and Customer payment in one transaction is not easy. A simple journal entry like yours is acceptable in short run to complete the transaction, but may not be correct.

- Bank charges as reported by (in GSTR-1) bank will be different from your books. This will lead to incorrect purchase reconciliation.

- For annual reporting of purchase (through GSTR-9 and 9C), HSN breakup by tax rate is required for purchases as well. It will be then a headache to deal with such transactions.

There could be a simpler form for this, for booking 2 transactions easily but it has a very specific use case of yours and a customization for Export is a way to go.

Let us know if you have a better suggestion to deal with such transactions.