I need some assistance with adding delivery charges with GST. Here’s what I’m trying to achieve:

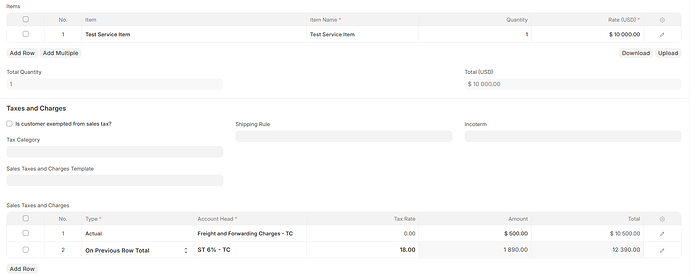

- Add Delivery Charge: I want to include a delivery charge of ₹500 in the Sales Invoice.

- Apply GST on Delivery Charge: The GST should be calculated on the combined total (item total + delivery charge). Specifically, I need to apply 18% GST, which includes 9% CGST and 9% SGST.

In GST and Tax breakup table, i need this caluculation(18% on 500 and 18% on item total)

Could anyone provide guidance on how to achieve this in ERPNext? Any help or steps would be greatly appreciated!

Thanks in advance!