Although not well documented, Frappe Support and other experienced users suggest using Item Tax to handle non-taxable items.

I feel something is missing or I’m doing something wrong.

In New York, there are 83 tax jurisdictions with unique rates. I created 83 Tax Categories, 83 Tax rules and add the Tax Category to the customer or customer’s address. This helps to assign the correct jurisdiction for the account head and rate.

I’ve tried to use Tax Rules to assign the tax category. In Tax rule there are fields for Item and Item Group. These are misleading because the tax rule only applies the tax category, it has no impact on the tax calculation. This means Item/Item Group is essentially ignored.

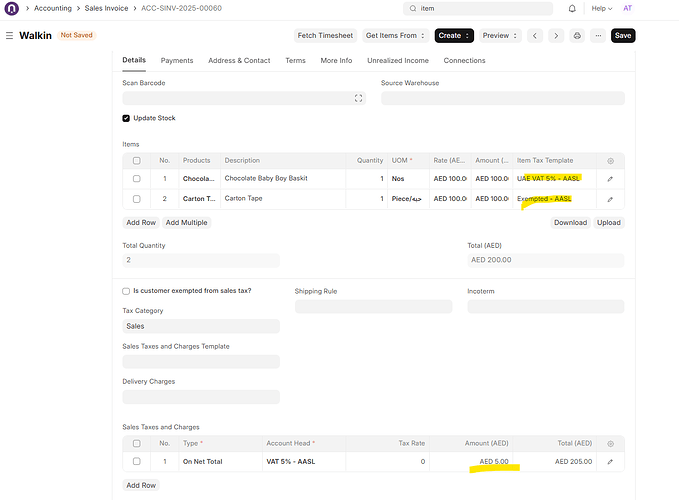

Enter Item Tax. This seems to solve most of the problems. I created 83 Item tax templates and assigned all 83 to the Non Taxable Item Group. When creating a Sales Invoice, my tax calculation is correct.

In the Item Tax Template I use the same account head as the matching jurisdiction’s Sales Taxes and Charges Template. This keeps the child table limited to the single jurisdiction rate. If I use unique accounts for taxable and non-taxable, the system will assign tax all items in the invoice.

Now the issue:

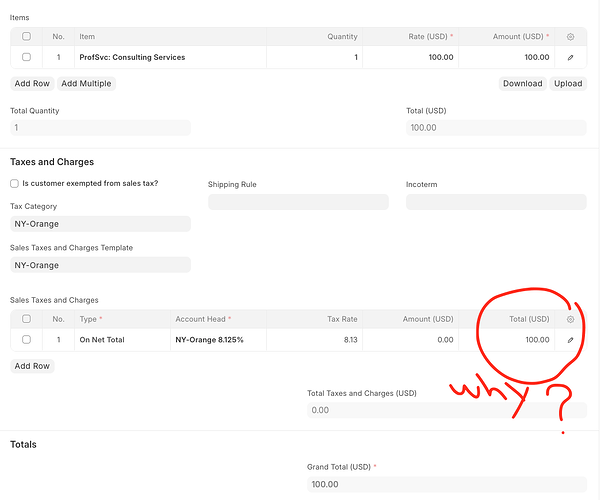

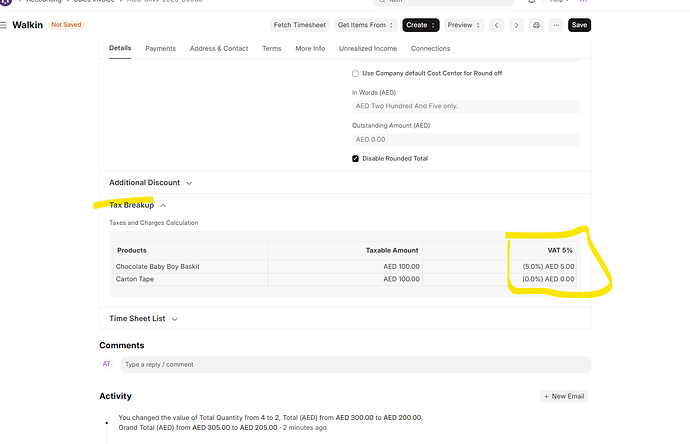

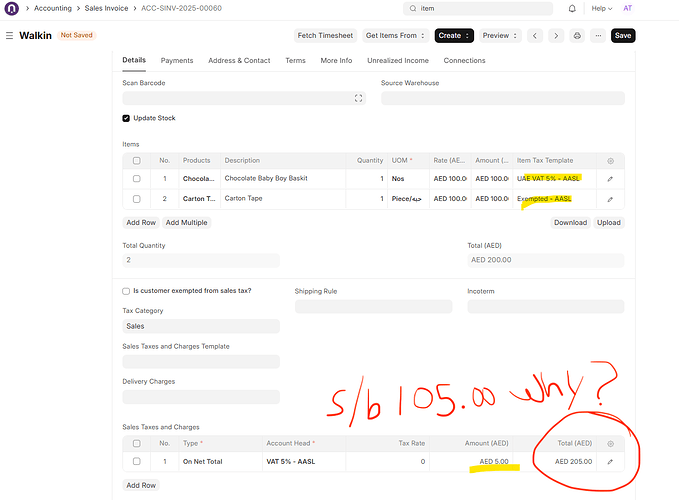

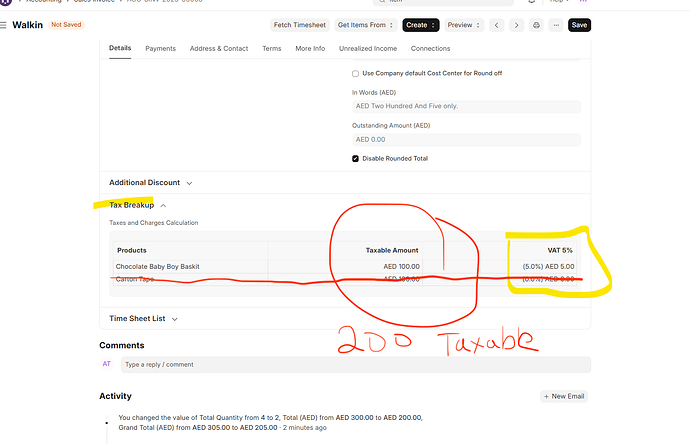

Eventhough the tax is calculated correctly, there is no record of the taxable amount. I think it’s a bit odd that the child table has a total for the full invoice, not the taxable amount.

Before I go create a complex Sales Tax report to try and calculate the taxable amounts, I’m asking here if I’m doing something wrong.

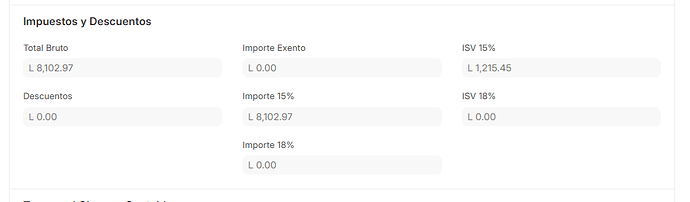

How are others handling Taxable and non-taxable items in the same invoice?

Does anyone know why the total row in the Sales Taxes and Charges table is a running total of the invoice and not the items getting taxes applied?

Should I eliminate the use of Sales Taxes and Charges templates and only use Item Tax Template? I still think I’ll be missing “Taxable Amount” due to the way the Taxes and Charges child table in Sales Invoice calculates the total.