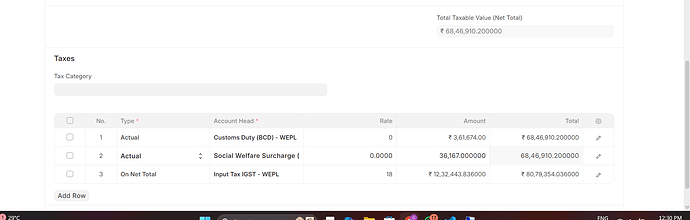

In bill of Entry the charges are calculated like this IGST on Import =

(Assessable Value + BCD + SWS) × 18%

But the Bill of Entry is not capable of handling the above formula in taxes

Do help me out.

Duty Type | Amount (₹) – | – BCD (Basic Customs Duty) | 3,61,674 SWS (Social Welfare Surcharge) | 36,167 IGST | 15,06,389 Total Duty | 26,41,722 Interest | 1,086 Total Paid | 26,42,808

Assessable Value (CIF)

-

Basic Customs Duty

-

Social Welfare Surcharge

= Value for IGST

Difference is IGST and IGST cannot be set actual giving validation error

72,33,495

-

3,61,674

-

36,167

= 76,31,336 approx

IGST @ 18% ≈ ₹15,06,389