Why Actual cost always 0.000. How can i add value in Actual Cost?

You would have to pass a journal entry against the relevant account

Dear @Pawan

Can you show me more example or detail about this.

@Pawan @Ah_Pu_Richard @Ah_Richard

When updating the Purchase invoice or the Payment, the journal cannot be passed to the expense account?

I am using this tool for my budget tracking against the PO’s. Not for any other accounting purpose. If I close the PO by generating the Purchase Invoice, Purchase receipt and then Payment, it gets updated for the Cash and Creditor only. Whereas, it is not reflecting in the budget variance report.

If I pass the journal entry separately against the expense account, it is calculating the actuals. But, it cannot be automatically calculated while passing the PO or PI or PR?

Hi,

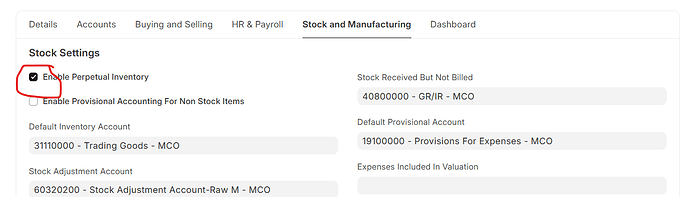

If you want to expense out immediately upon purchase, you can do so by disabling perpetual inventory in Company as follows:

Please note follow points before doing it:

Non-Perpetual Inventory System:

- No real-time updates: In this system, inventory records are not updated continuously for each stock transaction. Instead, the inventory balance is determined only at the end of the accounting period through a physical count.

- Limited visibility: This system provides limited visibility into inventory levels throughout the year, making it challenging to track stock availability and manage inventory costs effectively.

- Manual adjustments: At the end of the period, any discrepancies between the physical count and the recorded inventory balance are adjusted through manual entries.

Example:

A small retail store uses a non-perpetual system. They purchase a shipment of 100 shirts but don’t record this transaction in their accounting system until the end of the month. When they conduct a physical count at month-end, they find that only 80 shirts are in stock. They then record an entry to adjust the inventory balance to 80 shirts.

Perpetual Inventory System:

- Real-time updates: This system records inventory transactions in real-time, updating inventory balances after each purchase, sale, or adjustment.

- Enhanced visibility: This system provides a constant view of inventory levels, enabling better stock management and cost control.

- Automated adjustments: The system can automatically adjust inventory balances based on transactions, reducing the need for manual entries.

Example:

A large online retailer uses a perpetual system. When they purchase a shipment of 100 shirts, the system immediately records the transaction, increasing the inventory balance by 100 shirts. As customers purchase shirts, the system reduces the inventory balance accordingly. If a shipment is lost or damaged, the system can be adjusted to reflect the loss or damage.

Key Differences:

| Feature | Non-Perpetual | Perpetual |

|---|---|---|

| Inventory updates | End of period | Real-time |

| Visibility | Limited | Enhanced |

| Adjustments | Manual | Automated |

| Cost | Lower | Higher (due to technology and labor) |

Choosing the Right System:

The choice between non-perpetual and perpetual systems depends on factors such as business size, industry, inventory value, and management requirements. Smaller businesses with less complex inventory may find a non-perpetual system suitable, while larger businesses with high-value inventory may benefit from the real-time visibility and automated adjustments of a perpetual system.

@santhosh-velumani would need more screenshots information to suggest any solution on this.

This is resolved by updating the “expense account” in each item and “Expenses Head” in “Purchase Invoice”. Thanks