I have been running erpnext since July most of the material I purchased was in 28% bracket till 15th NOV , but now they have been changed to 18%.

I have set the GST rate in each item how do I update them to new rate without opening every single item.

I would prefer to update all items based on HSN code

@deepakk you can bulk update the tax rates and HSN codes using the Data Import Tool.

https://erpnext.org/docs/user/manual/en/setting-up/data/data-import-tool.html

@deepakk be careful when to update rates with respect to HSN codes. Depending on the description of item, the same HSN code can have different tax rates.

Firstly same item cannot have two HSN codes, I am talking of full 8 digit once.

This confusion happens only in case of 4 digit HSN code.

It would have been nice to have a system like in Tally where you have change in rates with effect date so that previous records are still available with correct data

The same HSN code can have different tax rates, based on application/description.

Additionally we have received invoices for the same item from two different vendors having completely different HSN codes. Both the descriptions fit the item.

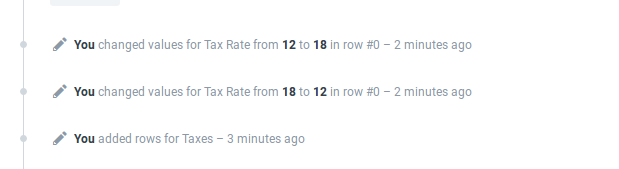

Anyway you could use document version to keep track of changes to Item tax:

Unfortunately Dhanajay its matter of Litigation , but as per HSN code spirit you can only have one type of item for a particular HSN code it has been fought in the courts example children cloth & toddlers cloth different import duty due to different HSN codes

People always try to classify there products in lowest duty structure sometimes in contervention to usage and sometimes rightly as in case of LEDS lights for tractors are different that led lights for buses !