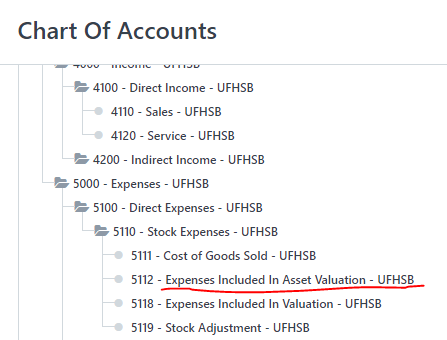

Hi community, does anyone know the purpose of Expenses Included in Asset Valuation? From what I understand Expenses Included in Valuation are costs incurred from the purchase of inventory products i.e. freight, taxes and duties expenses.

Then what about Expenses Included in Asset Valuation? If it is expenses incurred from the purchase of asset (fixed asset), why is the account head placed under Direct Expenses>>Stock Expenses?

If anyone has the answer, please post here. Thank you in advance!