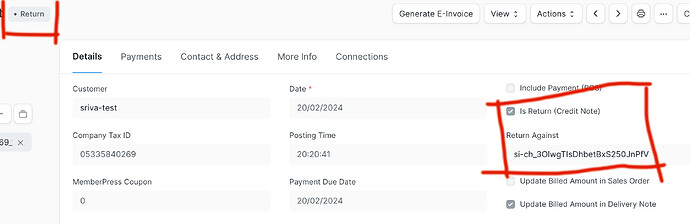

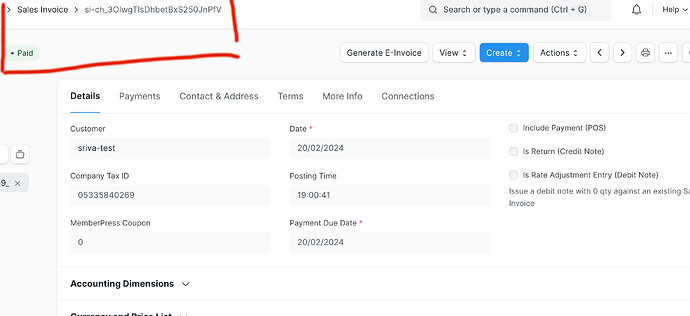

When create a return the system correctly link my invoice to the original document. But the original invoice remains in status “Paid”, the status should be “Credit note issued”. There is some bug in the latest versions? Let me know please.

Hi @sriva ,

Which version are you currently using?

Ciao @Dhruvin-Bhaliya

Version 14, I think the latest (Merge pull request #39690 from frappe/mergify/bp/version-14/pr-39689 · frappe/erpnext@c284d2a · GitHub)

Nobody else have this kind of problem?

There is some way to change the status of invoice?

Hi @sriva ,

It’s Working properly in version 14.

Sir, We are Using ERPNext v15.2.0 has the same issue kindly suggest some thing to solve this issue

thanks

Yes my version now is 14.62.3.

I think in some way if the system detect “Return Against” fields populated, the sales invoice linked should change the status, but nothing happens…

@Dhruvin-Bhaliya have you tested the 14.62.3 version?

Let us know, by me side I can’t correctly generated some charts for this problem. Thanks

Hi @sriva ,

I have tested on 14.62.3 and it’s working properly.

Thanks for the reply , but in my site don’t work. I didn’t change nothing in credit notes but the system stopped to change status of original invoices.

Anyone can help me to understand the problem? Thanks

Dear Mr. @sriva ,

This issue has been reported. Fixed in the version 14.62.4 - (The next updated version after your current version).

Change log of the new version explaining the issue + screenshot attached for your reference and conviction.

Please let me know if it solved the issue.

Dear Mr. @Aamir_Sikander ,

This issue has been reported. Fixed in the version 15.14.0.

Change log of the new version explaining the issue + screenshot attached for your reference and conviction.

Please let me know if it solved the issue.

Ciao @Kabir, many thanks for the update, finally the system is now updated at the version 14.65.0.

But I don’t understand the behaviour, I read the documentation https://docs.erpnext.com/docs/user/manual/en/credit-note

but when I create the credit note the original sales invoice remains in status of “Paid”. I’ve also created a new Payment Entry from Return document created but nothing change.

Can you explain the correct way to operate? Thanks

Dear Mr. @sriva ,

Thank-you for updating. I believe now it’s addressed.

Assuming, if it’s not addressed or if you need better understanding, I will explain you in simple - do-it yourself terms - for you to understand it better. Trust me, it would take 45 minutes, but, by then, you will master in this area.

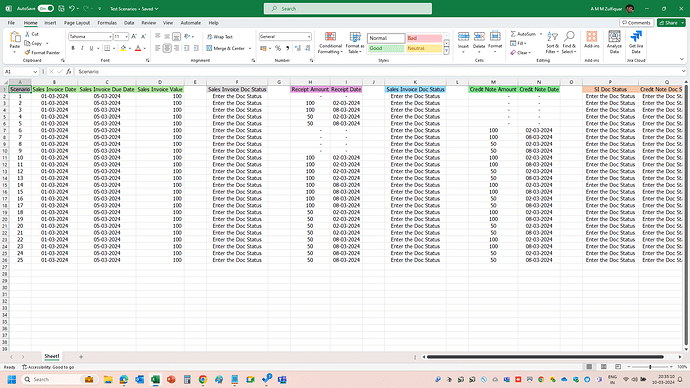

Example Test Scenario # Create a new customer - helps to test it on clean slate.

Create a 25 Sales invoices, each for 100. Check the attached excel file.

With the above in place, test the following # After each of the scenario, note down the status of each of the document and what you observe. Test these scenarios in a new invoice each time.

Dear @sriva ,

Tried uploading the excel file. could not. hence attached the screenshot.

If you find it difficult, let me know - I can email it, as well.

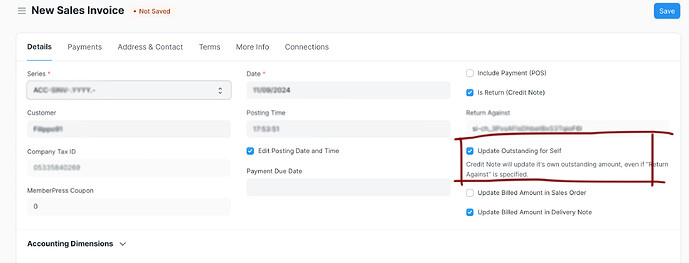

@Kabir …sorry for the late and thanks for the response, finally I solved the problem if an user want that sales invoice change the status in “Credit Note Issued” is necessary unselect “Update Outstanding for Self” checkbox.

I have another question, can you tell me how correctly manage the payment entry associated to sales invoice? …is not possible create a payment entry associate to the return.

Let me know. Thanks

Dear Mr. @sriva ,

Possible to explain with example?

Sure @Kabir, I found some video that explain partial refund of sales invoice, but no fully.

Now if I want totally refund an invoice, the correct scenario is this?

- I have Sales Invoice of 1k

- I have Payment Entry of 1k

- I create a Return of 1k (“Update Outstanding for Self” not checked)

- The Sales Invoice change status from “Paid” to “Credit Note Issued”

- I edit the Sales Invoice and create a new Payment Entry (with payment type pay)

Let me know if correct. Thanks

Where this Checkbox “Update Outstanding for Self” is present?