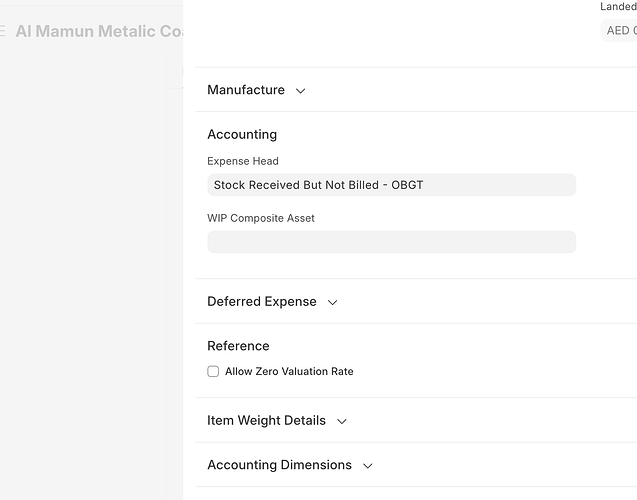

Want to know what is the functionality of WIP composite asset field in item table of Purchase invoice.

if the CWIP account is selected in Asset category the system is creating entries accordingly and when asset is submitted it moves value from CWIP acc to fixed Asset account.

but want to know if this specific field is it just for reference or there is any impact on asset accounting

Hi @Maveez

CWIP represents the costs accumulated for an asset that is still under construction or development and not yet ready for its intended use. Essentially, it’s a temporary holding account for these costs until the asset is completed and can be transferred to a fixed asset account.

The two doctype by which you can enter any kind of expenses incurred by using either Purchase Invoice or Journal Entry and both support CWIP recordings.

Step to Record CWIP type of Assets;

- Enter all associated costs via Purchase Invoice or Journal Entry individually (e.g. concrete, steel, wood etc.). Book everything on CWIP under relevant Asset Category.

- Create a Purchase Invoice for the finished house with the total costs of all items (e.g. tracking via Project, get from CWIP or calculate manually). Paid with CWIP account (this way all costs will be transferred to the fixed assets account).

- Create Asset using the Purchase Invoice created in previous step.

Principally in accounting terms ,CWIP accounts holds all expense until asset is ready for commissioning and when capitalized, all values transfer into that particular fixed asset account.

Please refer to this Frappe tutorial as well;