Hi everyone,

I’m encountering a recurring issue in Purchase Order → Purchase Receipt → Purchase Invoice where there’s always a small decimal difference (₱0.01 or ₱0.02) between the total item amount and the Input VAT total.

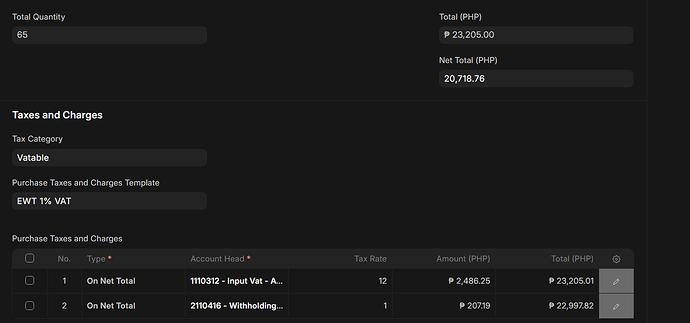

Here’s a recent example:

-

Total Items (Gross Amount): ₱23,205.00

-

Net Total: ₱20,718.76

-

Input VAT (12%): ₱2,486.25

- Computed Total: ₱23,205.01 (should be ₱23,205.00)

-

Withholding Tax (1%): ₱207.19

- Total after EWT: ₱22,997.82

As shown in the screenshot, the Input VAT total differs by ₱0.01 from the total items amount.

This happens quite often, especially when VAT and EWT are both applied.

Issue:

The decimal difference appears during rounding — either on the per-line item level or when ERPNext computes tax on net totals.

When multiple taxes are involved, these rounding discrepancies accumulate, causing mismatches between:

-

Purchase Order

-

Purchase Receipt

-

Purchase Invoice

Expected Behavior:

The Input VAT total should match the gross total of items exactly (no decimal difference).

Steps to Reproduce:

-

Create a Purchase Order with a total of ₱23,205.00 and apply 12% Input VAT and 1% EWT.

-

Save and check the computed tax totals.

-

You’ll see the Input VAT total becomes ₱23,205.01 instead of ₱23,205.00.

Environment:

-

ERPNext Version: (v15.45.4)

-

Frappe Version: (v15.81.0)

-

Currency Precision: 2

-

Global Defaults: Checked: Disable Rounded Total

Question:

Is there a way to synchronize rounding precision between the item total and computed tax total so that all documents (PO, PR, PI) remain consistent?

I’ve attached a screenshot showing the discrepancy.