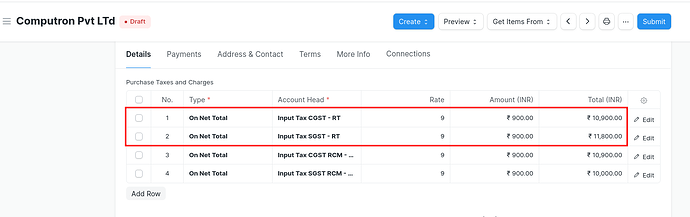

How can we configure the accounts for RCM deduction in the purchase invoice for the accouting entries

Account

Professional Fees(Dr) ₹10,000

RCM Input Tax - GST(DR) ₹500

RCM Output Tax - GST(CR) ₹500

ABC Supplier (cr) ₹10,000

Thanks for the response

But our requirement is to Add input RCM and Decuded in the outout RCM Account.

This workflow is not implemented in India Compliance.

Can you share use-case from the compliance point of view ?