Hello,

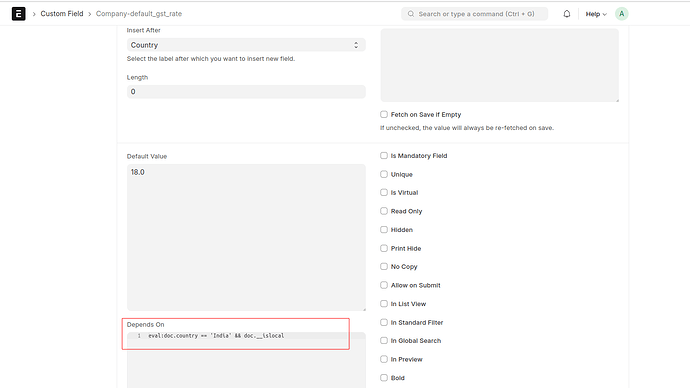

The Default GST Rate is a custom field in the company doctype that is currently hidden. You can make this field visible by modifying the document in the Custom Field Doctype. Remove the “Display Depends On” condition. Then, you will be able to see the field and select the correct option.

And revert the changes after editing the field.