Hello everyone,

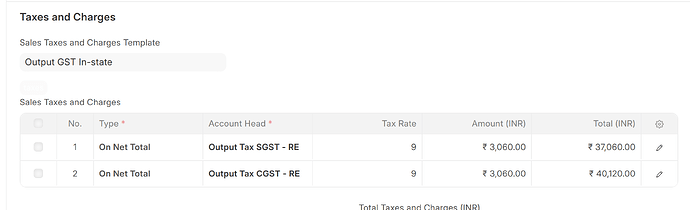

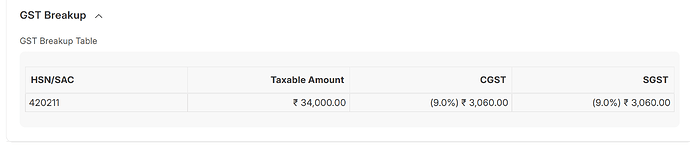

I’m working on Sales Invoice and Purchase Invoice with india compliance, and I’ve noticed that both include a “Sales Taxes and Charges” table as well as a “GST Breakup Table.” However, I’m a bit unclear on the differences between these two tables.

Specifically, I would like to understand:

- What is the primary difference between the “Sales Taxes and Charges” table and the “GST Breakup Table”?

- Why are the details in the “GST Breakup Table” not reflected in the “Sales Taxes and Charges” table?

I want to ensure I’m using these tables correctly for tax calculations and reporting. Any insights or explanations about their usage and the distinctions between them would be greatly appreciated!

Thank you!