Hello,

We are having a problem that we cannot trace. The “Total Taxable Value” in 3.1 of GSTR3B is coming to be different than the “Total Taxable Value” in GSTR1. The figures for Sales Register, GST Sales Register, and GSTR1 are all the same and correct. However, the “Total Taxable Value” in GSTR3B is Rs 22,99,694.6 less than the “Total Taxable Value” figure in GSTR1.

This Rs 22,99,694.6 amount cannot be attributed to any single invoice. The Place of Supply and GST details are put in all the invoices. Do you have any recommendations of what I should do and what could be wrong?

Thanks!

Please verify the Customer’s GST Category

Apologies for the late response. I checked the GST Category and it is Registered Regular for all the customers and all the sales invoices made.

The main question is that if the GSTR1 shows the correct figures, even the GSTR3B should show the correct figures right? All the invoices also have the correct Place of Supply mentioned.

I also see such a difference between GSTR1 and GSTR3B. Did you get hold of the problem?

Ok, I see that GSTR1 does not consider return invoices, unlike GSTR3B.

@Deepesh_Garg @snv

Sorry Guys had to tag you. Shouldn’t the taxable value reduce after return invoices in GSTR1?

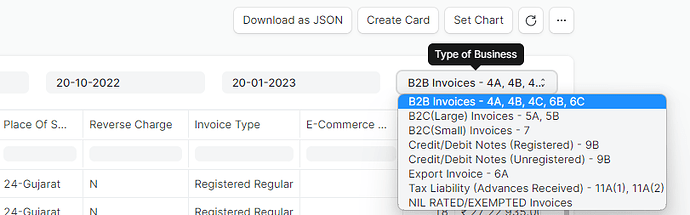

Did you check this filters?

1 Like

I have seen this difference with B2C Small. Ok there is a separate report for debit and credit notes.

Hello @Smit_Vora

I’ve got two requisite questions related to the image you posted:

-

Does the Indian compliance module or ERPNext inherently support the GSTR-9?

-

Also, could you guide me on how to navigate to the specific interface shown in the image? Specifically, what keywords should I input in the awesome bar of ERPNext to locate the report/form/list view and view/apply the filters as seen in the interface (the image you attached)?

My current setup docker based configuration:

- Frappe Framework Version: v15.0.0

- ERPNext Version: v15.11.1

- India Compliance Module Version: v15.5.1