I’m facing a discrepancy issue between the Stock Ledger valuation and the actual value posted in the General Ledger for a purchase invoice and a landed cost voucher. I would appreciate some guidance in understanding why this difference is happening, and how the rounding and landed cost allocations are impacting the accounting entries.

Here are the details:

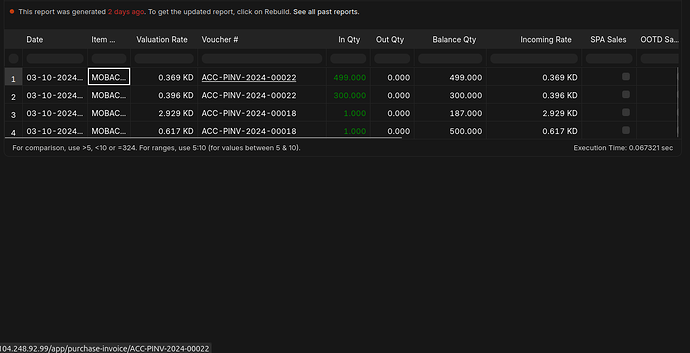

- Stock Ledger Report :

The PI in question now is ACC-PINV-2024-00022

The total value of the incoming items in the Stock Ledger is 302.931 KWD. You can see the incoming quantity, valuation rates, and total valuation for different items purchased.

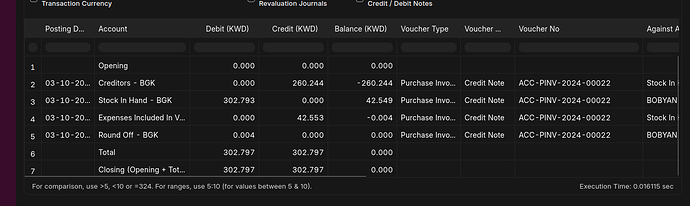

2. General Ledger Report :

In the General Ledger, the value hitting the “Stock In Hand - BGK” account for the same transaction is 302.793 KWD. There’s also a round-off adjustment entry for 0.004 KWD. The total of these values balances out the transactions. I would like to understand where this rounding difference is coming from and why there is a need for the round-off.

-

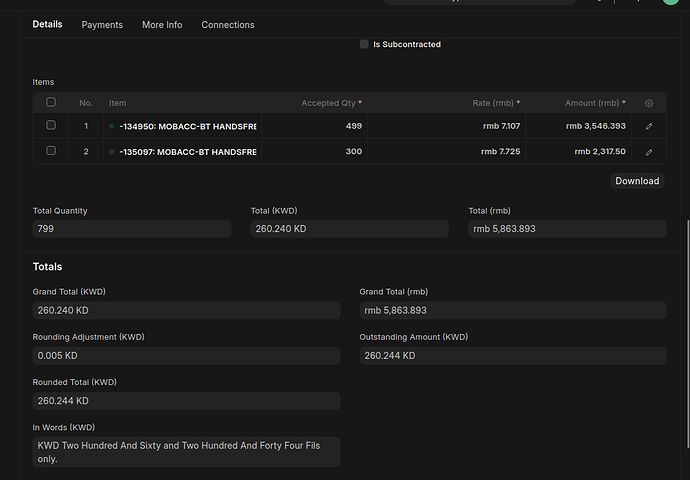

Purchase Invoice Details:

The purchase invoice (ACC-PINV-2024-00022) shows details like the accepted quantities and the total valuation in KWD and RMB. This data forms the basis for the stock value calculation.

-

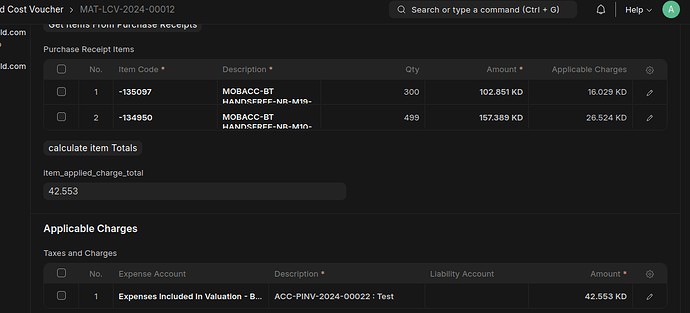

Landed Cost Voucher (Image 4):

A Landed Cost Voucher (MAT-LCV-2024-00012) is also added to adjust the cost basis of the items. It allocates 42.553 KWD as additional expenses to the items.

Summary of Issue:

- The Stock Ledger Report the total value as 302.931 KWD, - calculated as sum of incoming rate * incoming qty for both items (valuation rate is same)

while the General Ledger reflects 302.793 KWD under “Stock In Hand” after adjustments.

- There’s a round-off entry for 0.004 KWD.

- Landed Cost Voucher has been used, adding 42.553 KWD to the inventory cost.

My Questions:

- Why is there a difference between the Stock Ledger valuation (302.931 KWD) and the actual value in the Stock In Hand account in the General Ledger (302.793 KWD)?

- How is the round-off adjustment (0.004 KWD) calculated, and why is it needed in this scenario?

- How exactly is the Landed Cost Voucher affecting these valuations, and is this discrepancy related to how ERPNext allocates these costs?

Any insights or explanations regarding these differences would be highly appreciated