I’m wondering what is the correct Advance Account when creating Employee Advance?

Is it an Expense or Receivable (Since Employee still can return the amount)?

Employee advance accounts act as receivable account, if its salary advance you have to deduct when you post salary entries, if its iou type payment you have to settle it when employee present the expenses details together with supporting untill settle it is receivable

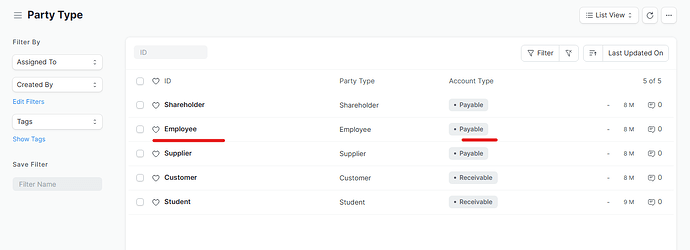

I used receivable account earlier, but when there is a Return, the Payment Entry showing error because “Employee” doctype should be Payable, not Receieveable whereas when I create a new employee advance, it is treated as Employee Receivable. So in my case, when i’m using Receieveable account, 100% of the amount should be settled as employee claim. it is not allowed to Return the employee advance.

If you need settle the advance go to the related advance and there is an.option for expenses claim and return with using mentioned option you can settle the advance payment

Thanks for reply Vijitha,

I mean here, i know how to settle the advance but if I settle the advance by choosing “Return” option:

- It will redirect me to Journal Entry

- Once I submit, it will error because the advance is booked as Receivable account.

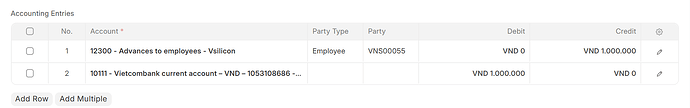

This is what looks like in the Journal Entry after I click “Return”

No 1 is Receivable

No 2 is Petty Cash

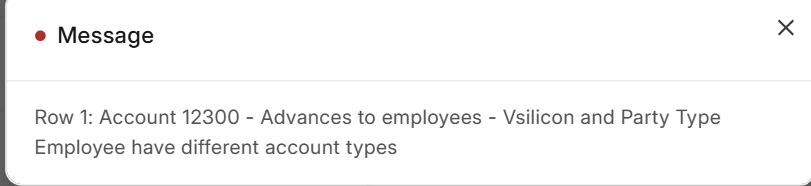

When I submit this document, it will showing this message

Translation: “Row 1: {Receivable Account} and Party Type Employee have different account types”

Can you check the account type of 1132.001 in the chart of accounts and change it to as receivable

Hello pak @oscarutomo

Previously on my side, when our staging was using v14.29.3 the return entry was working and it was ignoring the party type.

now we’re using v14.34.x and the issue occurs

What version is your machine?

Any update regarding this issue?

yes, it happens after i update erpnext

i’m using ERPnext v 14.36

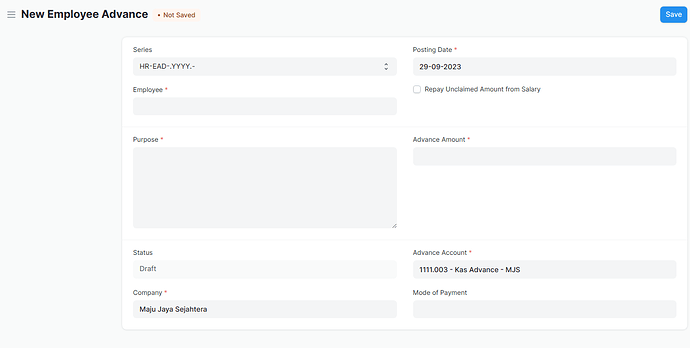

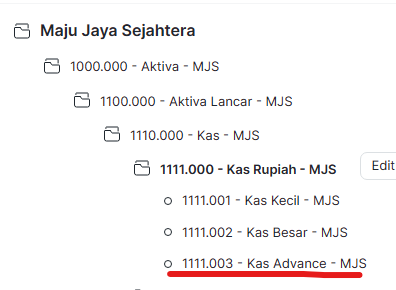

I solved this issue by creating a new account called “Cash Advance”.

And later, either it is Returned or Claimed at the end Cash Advance should be 0 again.

Seperti apa tuh pengerjaannya pak?

Saya masih belum paham flow nya.

Cash Advance itu sebagai pengganti 1132.001 nya kah? tipe nya Cash gt ya?

Boleh ajarin saya pak?

Saya pakai seperti ini pak… tipe nya betul Cash.

Nanti ketika Employee Advance, Advance Account-nya diisi itu:

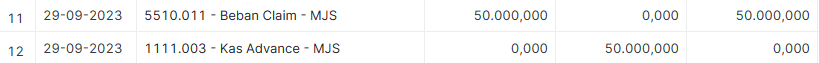

GL nya nanti seperti ini pak:

Di titik ini kan ada 2 kemungkinan:

- Expense Claim

- Advance di Return

Case 1:

GL nya nanti seperti itu pak

Case 2:

GL nya seperti itu

At the end, Kas Advance nya Rp 0. Jadi memang tipenya Cash tapi treament nya seperti Receivable. harus 0 diakhir

Oh, jadi karena tipe nya bukan receivable, ketika di Return udah ga masukin party employee lg di journal entry nya, gt ya pak?

iya pak

Hi @oscarutomo @Vijitha_Rajapaksha

I’m facing with this issue either and with your solution is using Cash Advance, how can you settle the Cash Advance with Employee Advance account. As when you creating journal entry, select Employee Advance account (receivable), system still requires Party Type and I cannot select Employee as this is Payable, different Account Type with Employee Advance account

i’m not using “employee advance” account anymore.

only “cash advance” account

can you give me insight why need to settle with employee advance?

Hi @oscarutomo , thank you for your reply.

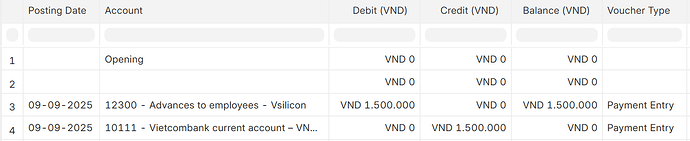

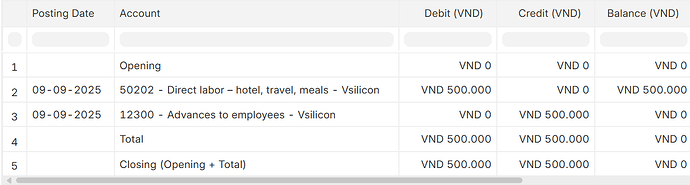

Here is the accounting ledger for full flow from Employee Advance (Payment Entry) → Expense Claim → Employee Advance (Return)

- Employee Advance (Payment Entry)

- Expense Claim

- Employee Advance (Return) - Employee should return to accounting department but not deduct to Employee salary

And the issue here is: when I submit ledger #3 - Employee Advance Return, system pop up below error message

Account Type for acct 12300 is Receivable, and for Party Type: Employee is Payable

Can you explain or provide full flow ledger when using ‘Cash Advance’? I appreciate your support.

I see.

So “Cash Advance” that I used basically is cash account. not Receivable Account.

That’s how I trick the advance issue.

The full flow is:

- Employee Advance (Payment Entry)

- Cash Advance (Debit) VND 1,500

- Vietcombank current (Credit) VND 1,500

- Expence Claim

- Direct labor hotel… (Debit) VND 500

- Cash Advance (Credit) VND 500

- Employee Advance (Return)

- Vietcombank current account (Debit) VND 1,000

- Cash Advance (Credit) VND 1,000

But this way, since “Cash Advance” account is not “receivable” or “payable” so the “Party Type” column will not showing any list so what I do is I type it manually “Employee” under Party Type and later “Party” column can show the list of the Employee.