How I cane create debit note for sales invoice

For sales we have to create credit note only,

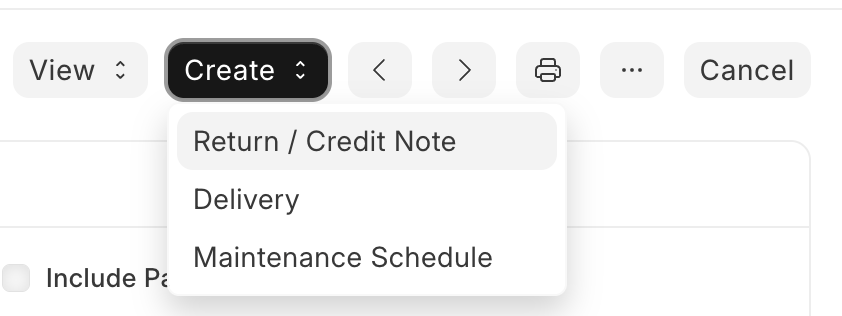

from sales invoice create → Return / Credit Note and choose the items to retuen and saubmit.

come on mate its right there on TOP.

Do look around for a solution first.

Also please go through the entire docs to know most of the things

To dig deeper, this is the best Youtube resource you can go though

@rk_root The author is asking for Debit Note for sale invoice.

A Debit Note is issued to a customer and used as a Rate Adjustment Entry on the Sales side, not just purchases.

Use Case (Sales Side):

Use Case (Sales Side):

- You sent a Sales Invoice to a customer.

- Later, you find out the rate was too high or there’s a discount that wasn’t applied.

- Instead of canceling the invoice, you issue a Debit Note to reduce the amount the customer owes.

How to Do It in ERPNext:

How to Do It in ERPNext:

- Go to Sales Invoice > New.

- Set “Is Rate Adjustment Entry (Debit Note)” = Yes (this marks it as a Debit Note from the customer’s point of view).

- Reference the original invoice.

- Enter only the difference (e.g., if the price was $100 and it should’ve been $90, just credit $10).

- Submit.

Effect:

Effect:

- Reduces the outstanding receivable.

- Keeps the audit trail intact.

- Adjusts revenue and tax correctly.

Tip:

Tip:

Mention “Rate Adjustment Entry” in the Remarks or Purpose field so it’s clear in reports and for your accounting team.

Hope you may a Solution Now.

I did these steps for entering the debit note. but the outstanding amount didnt change. for context, we have a customer that paid about 2000$. and due to some few differences which is about 0.5 only that was rounded to 1. so the customer outstanding is 1. we need to issue a debit note for that 1 dollar. note that it’s not the only customer with this issue and it’s not always 1. we need a debit note to account for taxes.