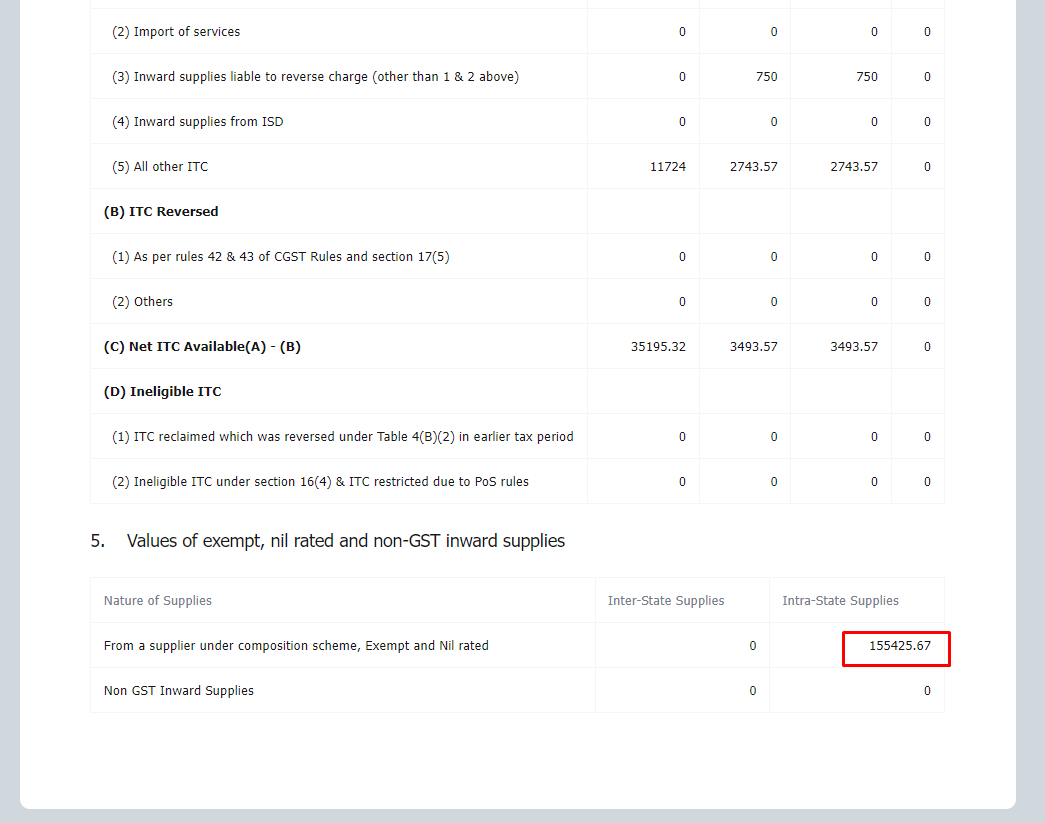

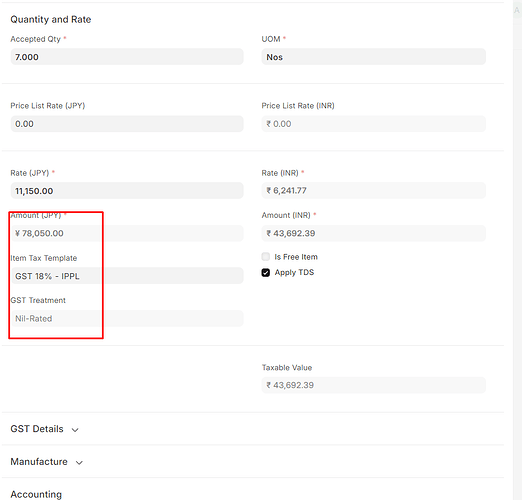

When I enter a purchase invoice for the import of goods, the amount should not be included in the GSTR-3B report (Section 5 - Values of exempt, nil-rated, and non-GST inward supplies).

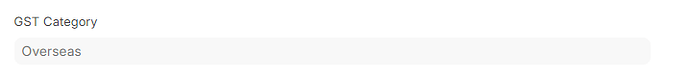

The GST category specified in the transaction indicates whether the sale is Export or Local. If the transaction is an export, the GST Category should be ‘Overseas’.

It seems that your current GST Category might not be set to ‘Overseas’.

thank you for reply

but, this is for purchase invoice with scenario of Import of Goods.

Can you share the GST Category specified for this transaction ?

any update on this?

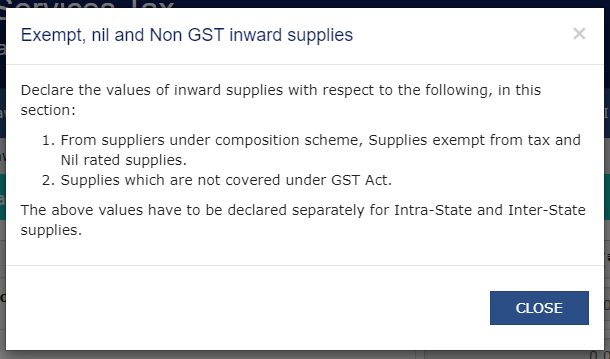

As per GSTR3b, all the exempted/nil-rated inwards should be part of Section 5.

If there is any contradiction open for discussion.

1 Like