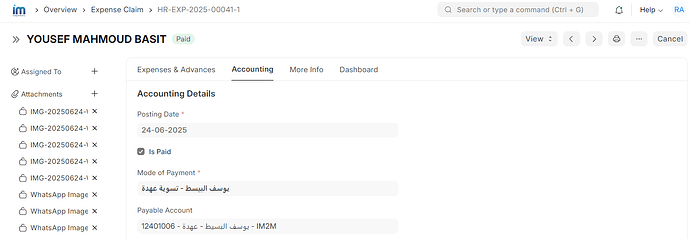

This is an expense claim with “is paid” option checked

What happened is an employee spent his money on something, and we paid him back. (for tax purposes)

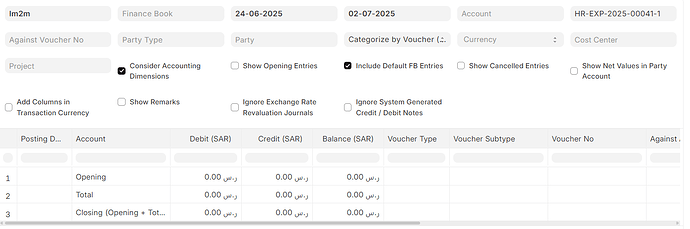

when showing account ledger, it is empty

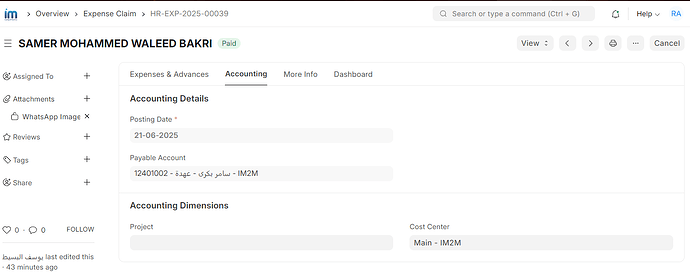

And this is an expense claim without the “is paid” option checked (instead, it is paid with a payment entry). (same scenario as before, but only with “the paid” option unchecked)

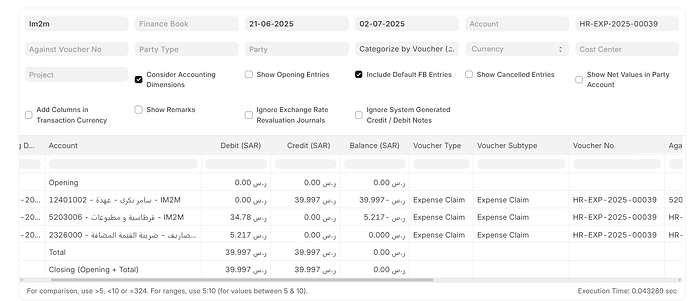

it has an account ledger

Target:

We need to understand what exactly the “is paid” option is for.

as most scenarios are when employees are paid back for their approved expenses.

And if it really meant for paid claims, then why is there no account ledger for it?