Hi

I have done a set of trail-transactions to learn and understand how things work.

Did one purchase transaction to buy stock

Did a manufacture-run to make the sub-assemblies ( Manufacture-1)

Did a manufacture-run to make the product (Manufacture-2)

Sold one product

If I post ALL the transaction detail it may be to much?

So I shall post a summary of the transactions that I made in power-point together with a

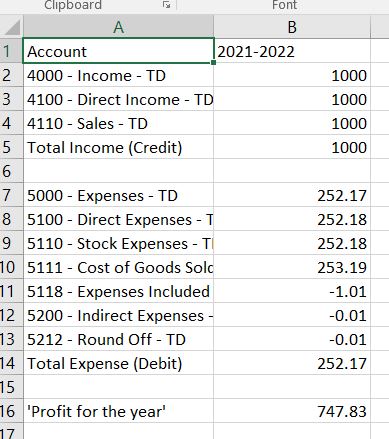

screenshot of the P&L spreadsheet which I exported.

And here is the spreadsheet

I have 2 questions:

During material transfer (Manufacture-1) R0-50 is transferred to “Stock in hand” but

R0-10 of that is via “Stock Adjustment” and R0-40 is directly to “Stock in hand”

And for the second manufacturing cycle ( Manufacture-2) the R0-51 is transferred

directly from “Expenses in included in Valuation” to “Stock in hand”

Is there a setting that I could have left out that can cause this inconsistency"

Second question:

In the P&L statement, the R253-19 “Cost of good sold” already includes the “expenses included in valuation” of R1-01. Why is this substracted from R253-19 to yield a cost of

R252-18 ? My cost is R253-19. So , as I look at it , less of my costs are reflected in my

P&L. Am I missing something,

If someone can please tell me what I am missing.