Hello all,

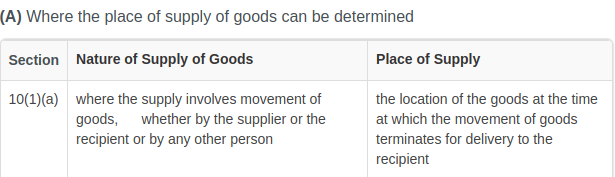

What if I want to charge GST from the billing address not from the place of supply? currently, the system doesn’t allow me to save the transaction if the place of supply is other then billing address and If I add taxes from the billing address

and also what if I want to change the place of supply in the sales invoice as it is auto fetch from the billing address there is a possible scenario where the customer wants to receive goods in a different state from their billing address

Usually PoS set is correct in 99% of cases.

For exceptions, you can change the Place of Supply manually in the Invoice.

Even if the state where goods are sent is different, it’s usually always as per billing address.

Refer to example 3.

If you need to be sure, consult your CA.

yes, the place of supply is from the billing address but if 3rd party is involved as per example 3 what if the customer directly wants to receive their goods in a different state from their billing address?

let me clear the scenario first

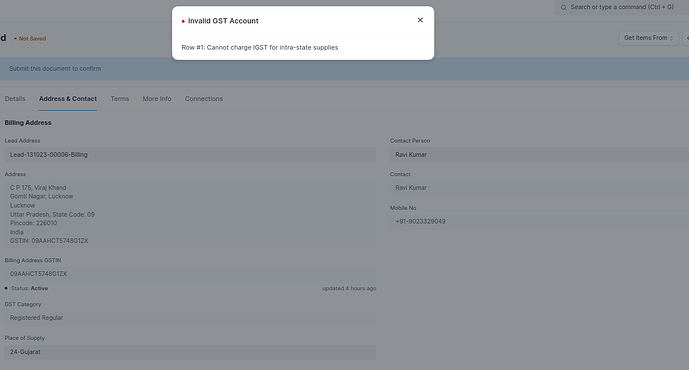

→ In quotation there is a lead whose billing address is UP

→ The party wants to receive goods in Gujarat so the Place of Supply will be Gujrat

→ Our company’s address is located in Gujrat

→ So basically it should charge IGST

the system only allows to apply Intera - state Taxes which will be not applicable, our CA also Confirmed that it should be IGST and the Place of Supply will be Gujrat,

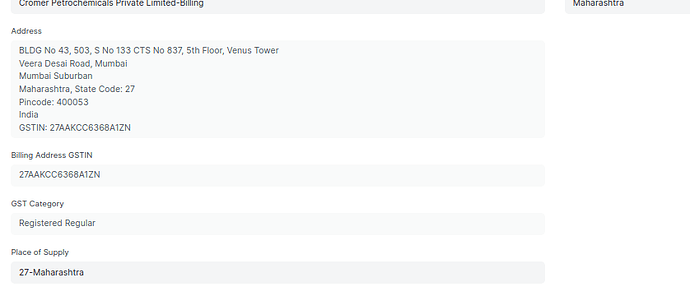

In your case Place of Supply should be UP and not Gujarat. Read the place of supply rules carefully or consult CA for the same.

goods are being received in Gujarat, which aligns with both the party’s request and our company’s location.

Can you share the screenshot of how this will look like in GSTR-1? Go to gst.gov.in and share screenshot of how you can have IGST for Place of Supply as Gujarat?

First Determine the Place of Supply → Is it UP or Gujarat? Take your CA’s help here.

If it’s UP → Only IGST can be charged by you.

If it’s Gujarat → Only CGST/SGST can be charged by you.

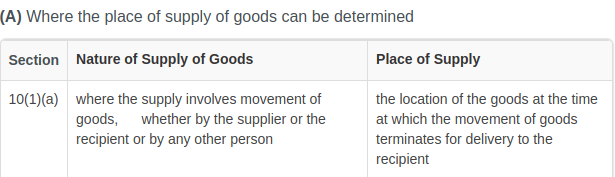

Also refer 10(1)(b)