Is it possible to configure both Sales and Purchase tax to map to same liability account.

For eg.

Under Current Liability → Duties and Taxes

→ CGST

→ SGST

→ IGST

Sales invoices are working fine.

But Purchase invoices are throwing an error stating

Row #1: IGST - CENT is not a valid GST account for this transaction

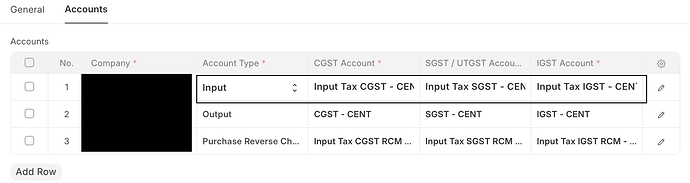

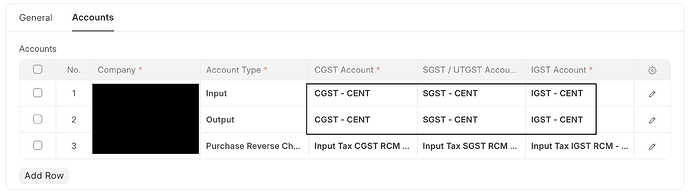

The following configuration seems to be the issue.

Why is the following configuration not allowed? Not allowing the same tax account to be used twice.

system is giving you the correct error because the general ledger (GL) accounts for input GST and output GST should be mapped separately.

Here’s a breakdown of why this is important:

Input GST: This is the GST that you pay when you purchase goods or services. It’s considered an asset because you can claim a credit against the GST you charge on your sales.

Output GST:This is the GST that you charge on your sales. It’s considered a liability because you owe it to the government.

Why separate accounts?

Accuracy: Having separate accounts ensures that you can accurately track the amount of GST you’ve paid and the amount you owe.

ITC (Input Tax Credit): By maintaining separate accounts, you can easily calculate the ITC that you can claim.

Compliance: GST regulations often require businesses to maintain separate records for input and output GST.

Thank you for the update.

Logically, this is correct.

But when I am migrating data from another software, for eg. Tally, this may not be true. Old system would be using same account for input and output.

Is there a workaround to allow this?

Also this might be depending on the practice of the organization whether they are using same GL for GST credit and Labiality or different GL, Hence we recommend to use seprate GL for Asset and Liability to keep proper track.

No sir, actually in Tally, GST payable for sales (i.e., liability) and GST receivable for purchases (i.e., asset) are mapped separately. Only then can you claim credit according to accounting standards. If they are the same, it will not comply with GST regulations. It would be better if you can explain this with screenshots.

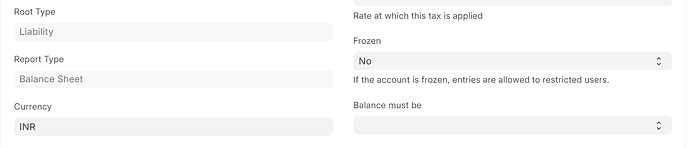

As a workaround in ERPNext, you can keep the name the same but define a different account number. I’m attaching a screenshot below. This root mapping defines liability and asset, so it won’t let you create duplicates of the chart of accounts.

Kind of hacky,

- Set your accounts as output accounts in GST Settings and import sales.

- (Optional): Rename accounts in Sales as Output accounts. This could be useful at a later point for reporting.

- After this, set them as Input accounts in GST Settings and import purchases.

Alternatively, override the validation, and set same accounts in GST Settings from backend.

This should help you complete onetime import of accounts.

I think this should do the trick for the imports part. Thank You.