I am using ERPNext 15.

I have configured GST. And I think it is configured properly as all the Taxes are calculated properly in Sales Invoice.

But when I create Purchase Invoice it is not calculating the Taxes.

I have checked and rechecked the configuration and everything is as per what is suggested in the documentation.

Can someone please help in solving this error?

Note: I am not creating Purchase Order and then creating PI based on PO.

Hello there is two categories of taxes purchase and sales make sure you are configurat the both

You have to configure Sales and Purchase taxes separately:

Sales Taxes and Charges Template

Purchase Taxes and Charges Template

Check if you have configured Purchase Taxes and Charges Template.

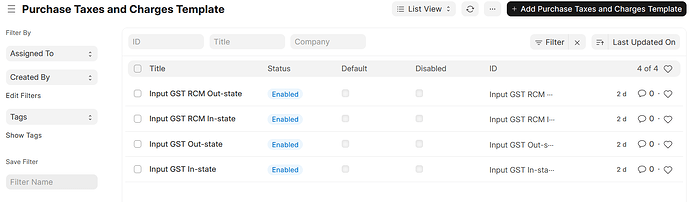

I have configured them already.

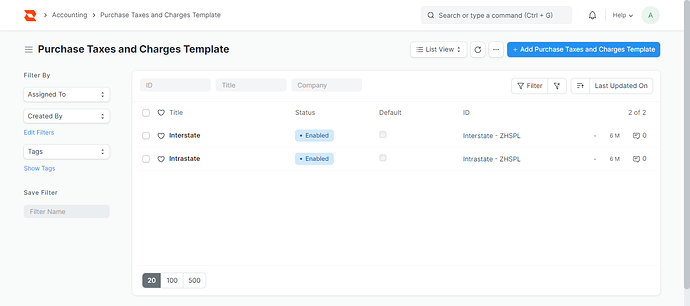

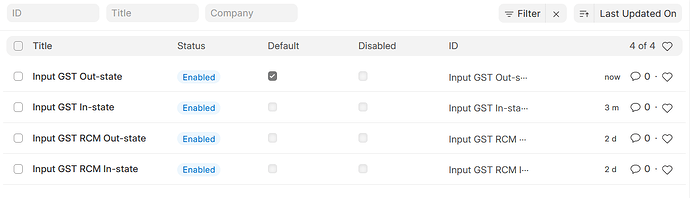

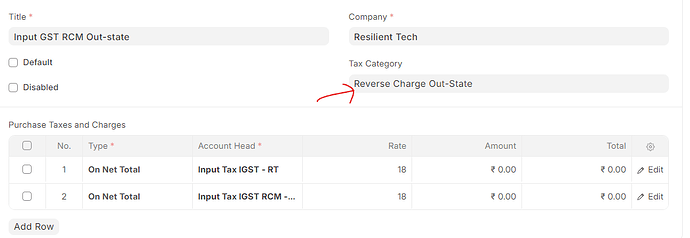

Here is the screenshot of Purchase Taxes & Charges Templates

I have also tried to follow these two videos.

But still it is not working for me.

Is there any other specific settings that I may have to change?

Oki this is template of taxe try to put one of theme by default and what category of taxe configure make it please make screen shot

I have set GST Out-state as Default

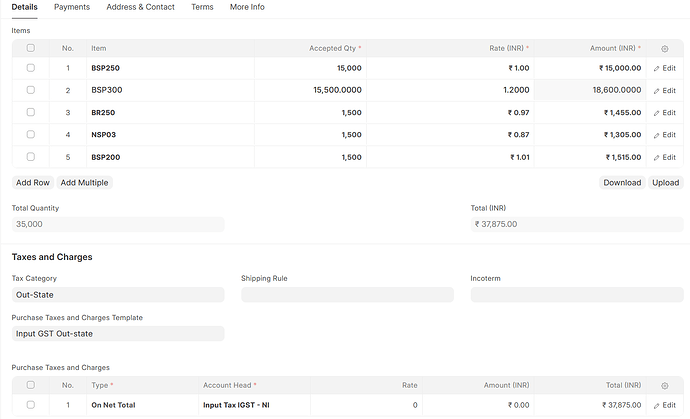

Here is a screenshot of the Purchase Invoice

Still Tax remains

Zero.

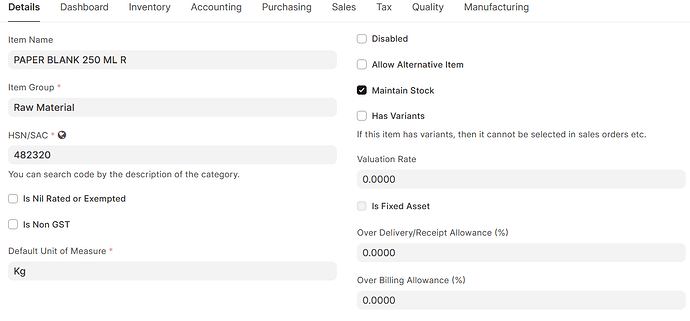

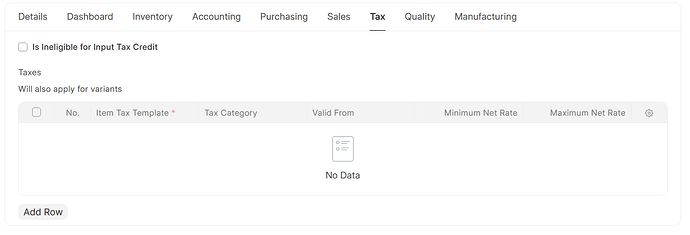

Can you also share the screenshot of item tax config.

The tax rate is zero as visible in the screenshot shared by you. You can set the rate as 18 or 9-9 in the purchase tax template, or you can configure the tax on an item level.

As per the videos that I have followed we just have to create necessary Purchase ad Sales Tax Templates and they will automatically apply as necessary.

But this is not happening. I want to understand why?

As a work around I am currently explicitly applying Purchase Tax Template to each Items that are purchased.

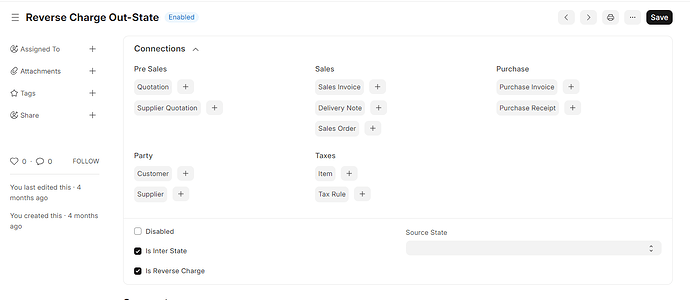

Is the tax category set in the purchase taxes and charges template? It’s required here currently.

Also, make sure it’s not set in any customer or party.

Tax Category:

1 Like