Hello Team,

In GST Export invoice have two cases. With payment Of IGST & With LTU. If We select with payment of tax option in GST detail section then following entries should be passed in ERP.

Without payment of tax (IGST): The goods or services may be exported without paying any IGST thereon under a bond or Letter of Undertaking after following the prescribed conditions.

With payment of tax (IGST): The goods or services may be supplied after charging the applicable IGST and subsequently, the refund for such IGST can be claimed.

Consider that an export has been made to Mr. Z located in a foreign country worth Rs. 1,00,000 and the applicable GST rate is 18%

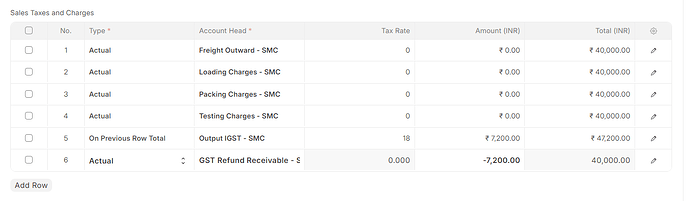

Export made with payment of IGST:

25.04.2018

Mr. Z A/c …………………Dr. 1,00,000

IGST Refund Receivable A/c ……….Dr. 18,000

To Sales A/c Cr. 1,00,000

To Output IGST A/c Cr. 18,000

Currently our accounting entries should be passed to customer ledger & actually customer is not liable to pay that IGST amount so we have to replaced accounting entries with above one.

@Smit_Vora @Lakshit_Jain if you can help on this

Thanks