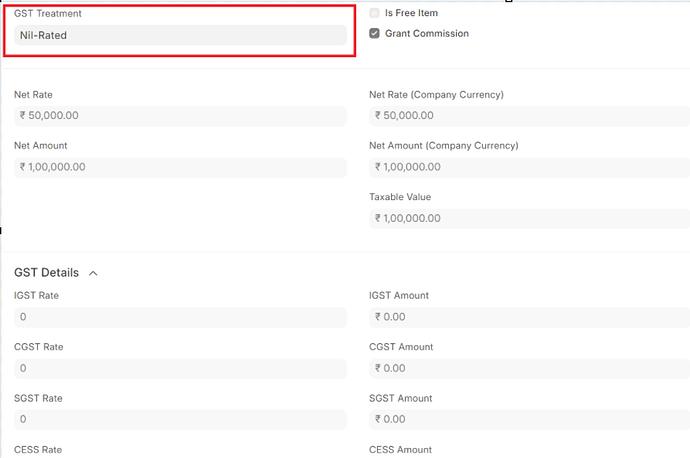

on sales order item table Fields “GST Treatment” with the same set of configuration and Customer, GST Treatment sometimes taken as “Taxable” and sometimes it is taken as “Nil-Rated” due to which it does not Compute GST

If no GST accounts(Accounts specified in GST Settings) are charged in the taxes, the Item is considered as Nil-Rated

Very Thankful to you for your prompt reply

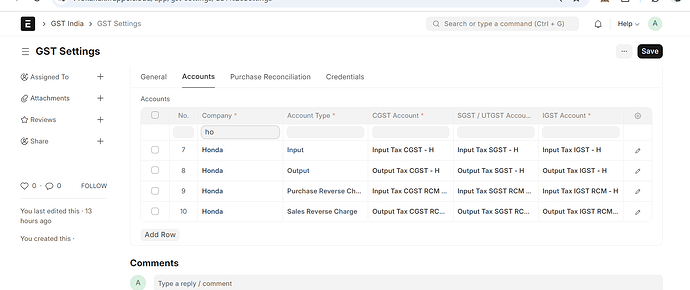

but I have specified the (Account under the GST setting)

@Lakshit_Jain @Smit_Vora please help me with the solution.

Nil-Rated is the default for transaction, if no GST is set in that transaction