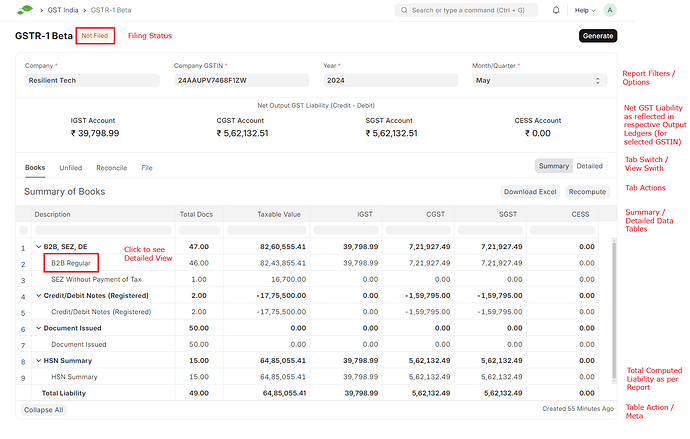

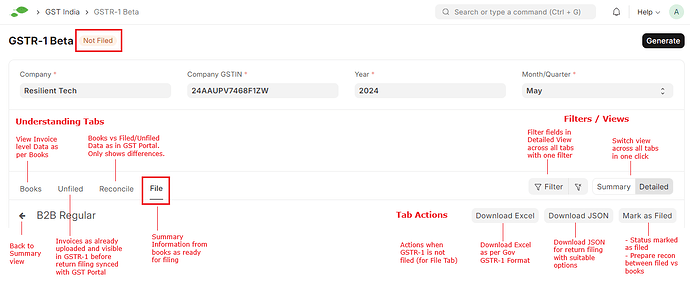

We are thrilled to announce the release of GSTR-1 Beta, designed to simplify your GSTR-1 filing process.

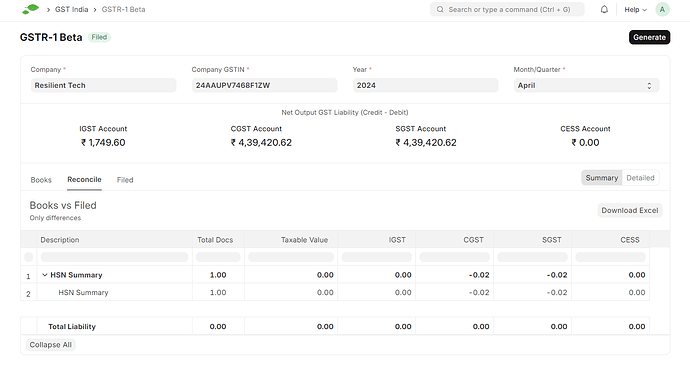

Seamless API Integration: Effortlessly fetch unfiled/filed data from the GST Portal to compare data before and after filing GSTR-1.Comprehensive Overview: Access a complete overview of Ledger Balances, Transactions, and data as per the GST Portal.Enhanced Control: Ensure data integrity by preventing modifications to Sales Invoices once GSTR-1 is filed.

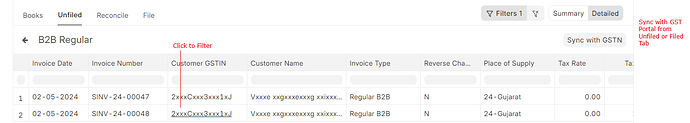

Take a sneak peek at some screenshots below!

GSTR-1 Beta is available in both v15 and v14 for you to try out.

Docs: GSTR-1 | India Compliance

Happy filing!

14 Likes

Hi Smit_Vora, I am wei xiang and just started learning on eprnext system. If I want to implement sst for malaysia inside erpnext what are the steps I can take into account for?

Hi,

I am not aware of laws and requirements for Malaysia or Singapore. But following doc could be useful for you to setup taxes.

https://docs.erpnext.com/docs/user/manual/en/taxes

Consider having new thread for more specific issue if something is not clear.

Oh I see, for HR part how can I add a new field like EPF for the Payroll category though? Any references you can suggest? This is for the ERPNext.

Stark

March 31, 2025, 12:17pm

6

I want HSN number column in that how i get?

If you navigate to Detailed View for HSN Summary then you will be able to see the HSN Number column.

Hope this helps.