I recently upgraded to version-15.

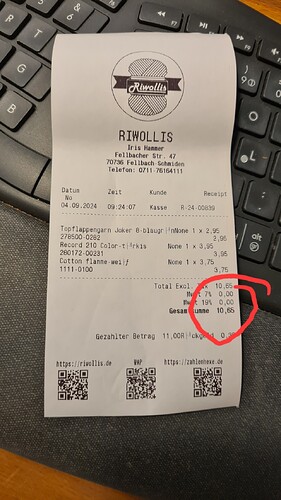

Now the tax is no longer taken into account when selling.

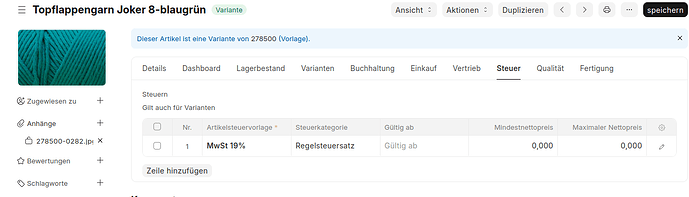

I use POS with item-tax-templates for the two VAT rates in Germany.

In version-15, the tax is not included on the POS Invoice or in the Sales Invoice.

Although the items have an item tax template with tax rate and tax account.

Has something changed so that templates can no longer be used?

I couldn’t find anything in the documentation and ‘Automatically add Taxes and Charges from Item Tax Template’ in Account Settings is enabled.

I have already written a bug report on github.

Because there are several items with tax in POS Invoices.

This isn’t really funny. At the end of the month I have to submit my VAT return again. This should be sorted out by then.