Discussed in 2 sections…1)Accounting setup…2)Making the calculations…

- The accounting

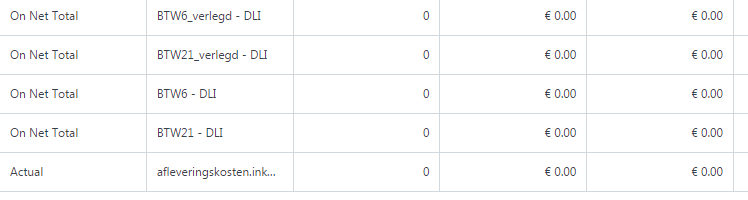

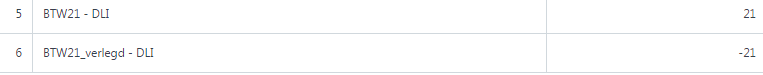

I have 4 VAT account under liabilities… Two normal VAT for NL at 6% and 21%…and two VAT Reverse Charge accounts for stuff I buy elsewhere in the EU…

For Intra Community Purchases I have a tax template that hold all 4 VAT accounts

Items I buy not in NL have taxes setup like this:Normal VAT is normally charges and VAT reversed is charged negatively…

2…Making the 3 monthly payment to the tax authorities.

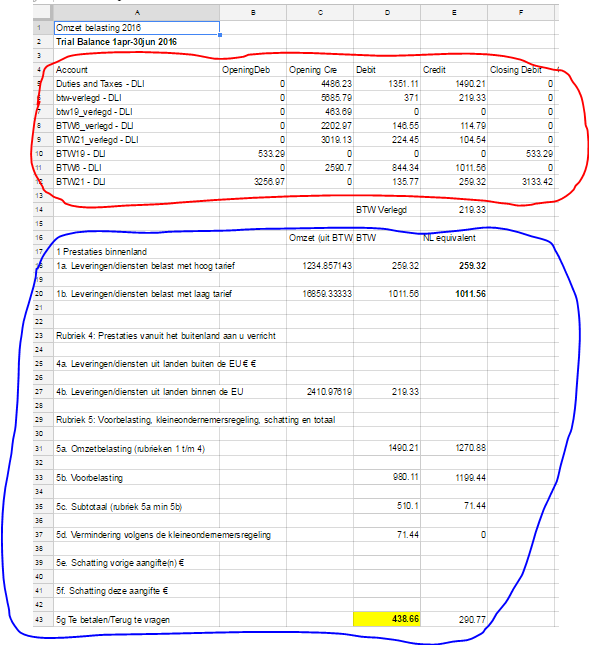

I have set up a spreadsheet (Google sheet) where i copied the calculation form for the Netherlands.

For reporting trimester 2 (1 april-30 June) go to the Trial Balance in Erpnext and enter the period.

Copy the tax info into the spreadsheet

Link the cells for the calculations (NL system) to the cells from the trial balance.

This you have to set up one time …

For a next trimester Copy the whole sheet to a new tab

Select the trimester in trial balance and copy in the correct position…The VAT is calculated automatically

Done…Pay the tax authorities…

See screenshot below::: The red encircled part is copied from the trial balance…the black is the NL VAT form and calculation