Hi everyone,

I’m working on a use case where I need to handle free items (zero rate or complimentary) received from a supplier in a Purchase Invoice in ERPNext. For example, when purchasing 10 units of a product, the supplier may provide 2 additional units for free. These should not affect the invoice value but must be recorded in the stock and shown in the Purchase Invoice for tracking.

I have a few questions:

- What is the correct way to add free items to a Purchase Invoice in ERPNext?

Should I add the item again with rate = 0, or is there a built-in method to mark an item as free?

- How does ERPNext handle stock valuation and accounting for free items?

Are free items excluded from the accounting side but included in stock?

Will this affect the stock valuation rate?

3.Is it necessary to separate free items into another Purchase Receipt or can they be combined in the same invoice?

- Can we track and report on how many free items we’ve received over time from a supplier?

Any guidance or best practices would be appreciated. If there’s a standard ERPNext way to handle this (e.g. using pricing rules or specific fields), I’d love to learn more.

Thanks in advance!

Hi @Ashnas

-

In order to record free items and add them as a separate line item in the Purchase Invoice (or Purchase Receipt). Set the checkbox Allow Zero Valuation Rate. This marks the item clearly as a non-billable, promotional free item from the supplier.

-

Accounting and Stock Valuation

- Stock: The item is added to your warehouse like any other item, increasing the stock quantity.

Valuation: Since the item is received at zero cost, the system does not assign it a value. This means it won’t impact your inventory accounts or accounts payable.

- General Ledger: No accounting entries are created for free items, so your financials remain accurate.

- Impact on Stock Valuation Rate

Free items do have an effect on stock valuation, especially if your company uses the Moving Average valuation method. In this case, receiving stock at zero cost will lower the average valuation rate of the item, which could affect your cost of goods sold (COGS) in future transactions. If you’re using FIFO, the zero-cost items will be

effecting on inventory Over time as you may issue newer (paid) stock, COGS will return to normal based on the cost of those batches. So if your inventory contains a mix of free and paid items, the overall average COGS might be lower until the free items are consumed.

- Can Free and Paid Items Be Combined?

Yes, there is no requirement to create separate Purchase Receipts or Invoices for free items. You can include both free and paid items in a single document. Just make sure to clearly mark the free items with a zero rate and use the checkbox or better to bring checkbox upfront into the item grid.

- Tracking and Reporting Free Items

Item wise purchase report and purchase register serve reporting purpose.

Thanks for your reply.

Can you tell me how to set it? Because I have tried a lot of possible ways, but not a thing working.

Where to set the free items ? Do I have to create new field for setting how many of them are free?

Hi @Ashnas

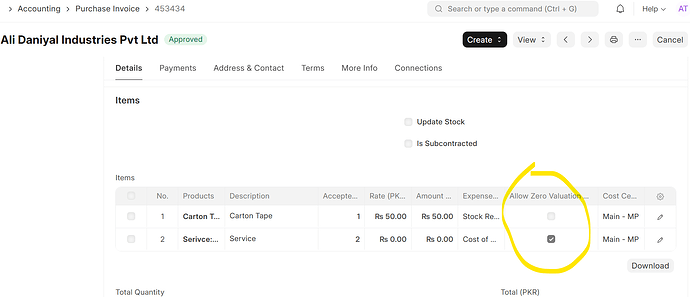

The following is purchase invoice item table grid where highlighted checkbox is what can help you record free of cost item from your supplier.

Hi @ahsantareen ,

I have selected a tablet and added everything for paid in 1 row and on the next row I have set the duplicate of the first row and changed the value of qty to value of free qty and then set price list rate as zero and then checked the checkbox which you said before. Before save it shows ok. But when saved, the amount for the free items also added to the total and calculate total gst.

I think my working is not on the proper way. Can you tell me the full process of how we should do this process of purchasing paid and free items at the same time with stock add but amount and gst should not count from free item?

Hi.

Try don’t use duplicate of the row with value products. Just add new row and select the item, qty, the field Rate = 0, and check Allow Zero Valuation Rate. Nothing else.

Regards

Hi,

Then how the paid item quantity will be priced?

Hi.

Use 2 row as Ahsantareen said.

If you buy 12 items A for $100 and get 1 item free:

Row 1 with the item, qty (of price items) and price: Item A 12qty x $100 = $1200

Row 2 with free item, qty (of free items) price =0 (allow zero valuation rate checked):

Item A 1qty x $0 = $ 0

Total Sale Invoice $1200

Qty of Items add to the stock 13

The Tax will be calculated about $ 1200

Regards

Hi,

But it looks like double the size of the purchase invoice, isn’t it?

I did it in such a way that on the purchase invoice I just show the number of free quantity that has to be added in purchase invoice and when submitting the purchase invoice, the items with free quantity are added to the stock through stock entry as material receipt type. Now the paid quantities are entered into the stock through purchase invoice and the free quantities are entered through material receipt.

But I don’t know if this cause any issues in the future. Do you think it will be good?