Hello All,

I don’t know whether anybody out there has felt the need of following or not.

This case is for an item that is purchased as well sale. (Is purchase = Yes and Is Sale = Yes)

At the Item level, we can define multiple item tax templates based on tax category and effective dates. In our case, we keep separate SGST, CGST, and IGST accounts/ledger for Input (Purchase) and Output (Sales). We also define one set of item tax templates for Purchase and another set for Sales as shown below screenshot.

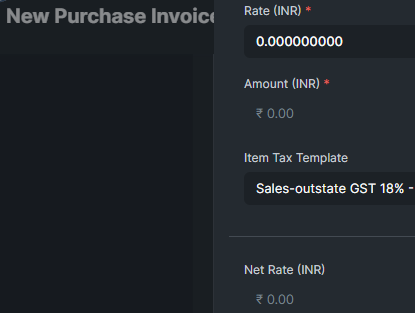

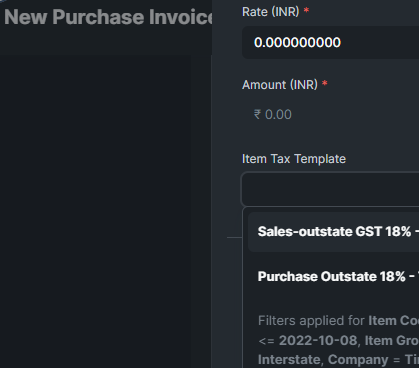

As per the current system working, it fetches the first matching item tax template based on tax category and applicable dates at the transaction level as shown below.

As it is a purchase transaction (purchase invoice), we expect the system to pick a purchase-related item tax template, it has fetched the first matching item tax template. In such cases, we have to manually and carefully select the item tax template at the transaction level as shown below.

Expectation

- Is anyone out there facing the same situation? If yes, how they are handling it?

- Can we have an option to specify the applicability of an item tax template to which transaction type (Sales or Purchase) in addition to tax category and effective dates under the “Tax” child table?

Extra Information

We are creating separate item tax templates for each and every tax slab under GST for Sales (Output Tax) and for Purchase (Input Tax). Also, we have separate ledgers/accounts in our COA, i.e. Input CGST, Input SGST and Input IGST for purchases, and the same way Output CGST, Output SGST and Output IGST for sales.

Somebody can also suggest how they handle this scenario and which is accepted by their accountant/CA/Auditor.