Hi,

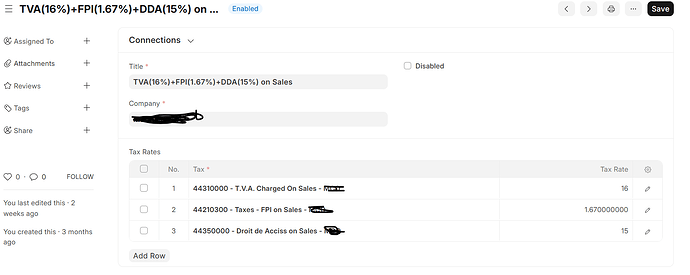

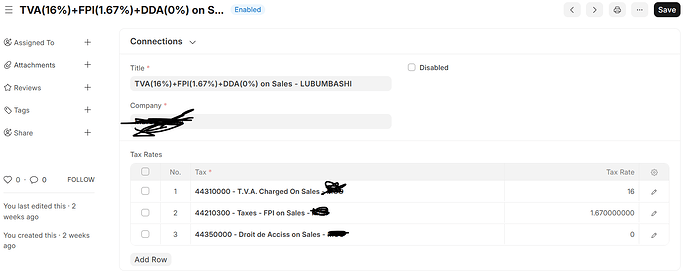

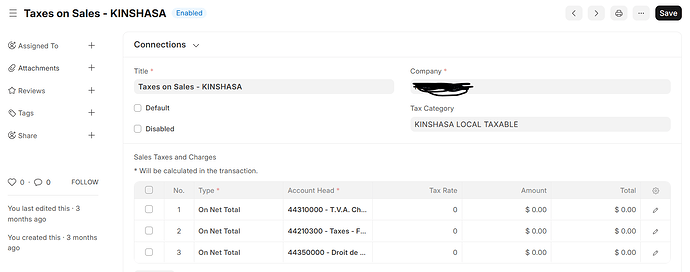

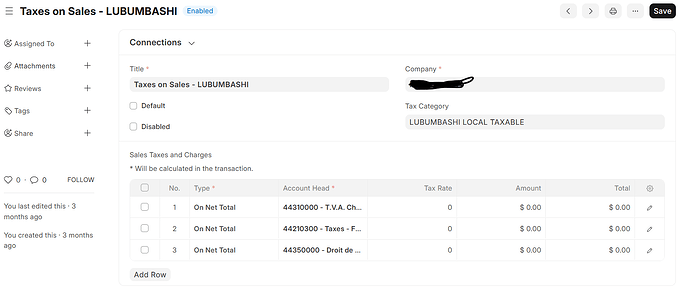

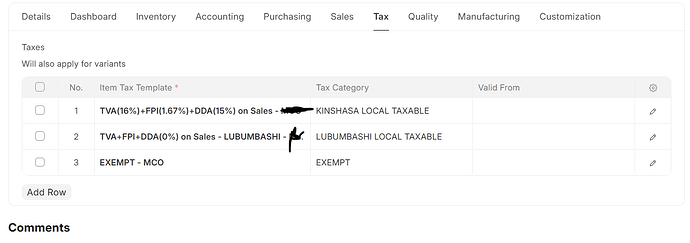

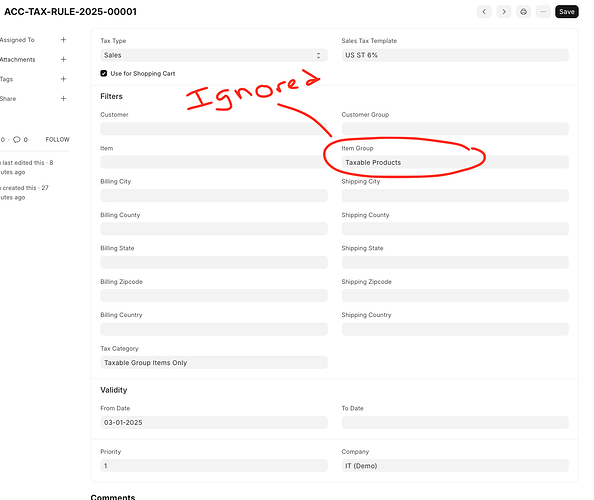

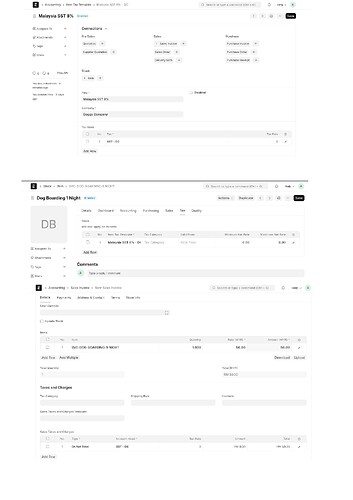

I can’t figure out how to exclude certain items from being taxed in a sales order. I have create my sales taxes and charges template that applies both provincial and federal taxes to my sales order. Some items are not actually sold but rather they are provided against a consignment (display refrigerators). I have made an item tax template of 0% for those specific items. Now , no matter what I do , the sales taxes and charges are always applied on these items, even if the item tax template is set to 0%. The sales taxes and charges is set to default and both tax lines are set to “On net total” so since my consignment value is part of the total , it gets taxed. I don’t understand how to properly exclude single items from being taxed. Am i supposed to make a new custom field for items to hold the consignment , but I’ll still want that amount to appear in the item list of a sales order / invoice. Will it need to be in a different column than the normal rate ? And then create new lines for totals , grand totals? I’m sure there’s a simpler way to have items excluded from taxes.

Thanks in advance for the help and pointers!