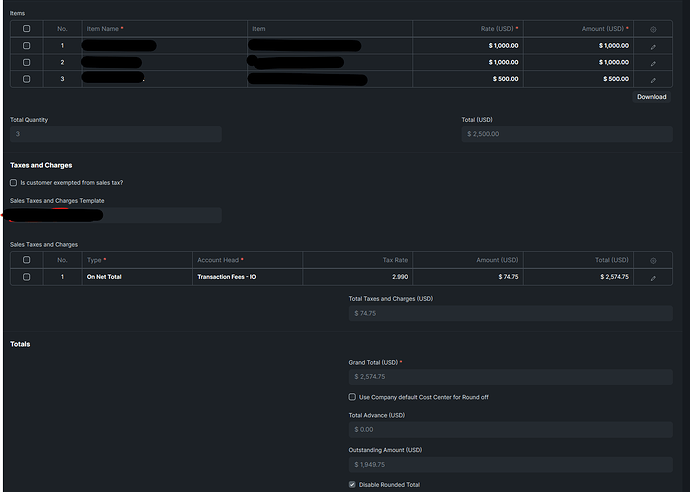

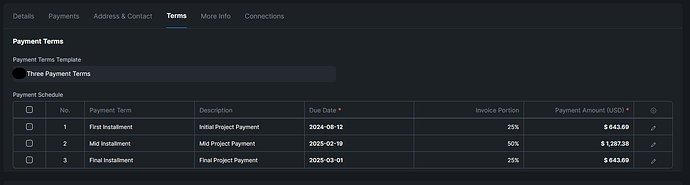

We have been making our invoices and using the Taxes and Charges section to include the transaction fees related to the payment mode the customer intends to use. We allow customers to pay in up to 3 installments currently, but the situation has arose where a customer paid their first installment using one payment method with one fee structure, and is now wanting to pay future installments using a different payment method with a different fee structure.

We’ve already created the invoice including the fees for the payment mode they initially picked so the fees are baked into that invoice. Their expectation is that by changing payment modes they won’t need to pay as much, and I agree- but with the invoice already submitted, how do I make this modification? How do I indicate on the invoice what the customer owes if the amount on the invoice depends on how they plan on paying for the invoice. It’s a circular dependency that I can’t seem to reconcile. Any help here would be very much appreciated.