Hi Experts,

Thanks.

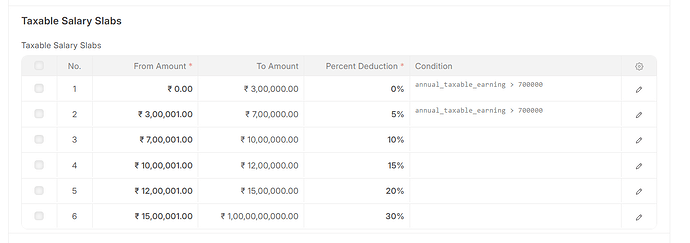

Pleas use below mentioned settings under income tax slab.

I have created and issue for this and 2 proposals on how to fix this issue.

opened 03:27PM - 29 Apr 25 UTC

bug

### Information about bug

As per the India Income Tax law - employees get margi… nal rebate u/s 87A.

Refer : https://cleartax.in/s/income-tax-rebate-us-87a

As per the tax slabs in New Regime - Income tax up to 12.75L is NIL (standard deduction of .75K applied).

But if the salary of an employee is marginally more than the limit, then the tax implication is big enough.

Sec 87A is available to account for this.

As per this section - If the taxable income is marginally more, then employee gets a rebate.

Consider, the total salary as 12.85L. After standard deduction, taxable salary is 12.10L.

Based on the tax slabs, income tax will be : 61500.

So, just for an increase of 10K in salary, net tax outgo is substantially higher.

In this case, the tax payable will only be 10K.

Rebate is calculated by formula : Total Tax - (12.10 - 12). So rebate = 51500

Tax payable = 61500 - 51500 = 10000

This section is not accounted for.

Kindly fix this on priority as this affects payroll processing of April 2025

### Module

Payroll

### Version

Frappe Version : 15.65.2

ERPNext version : 15.58.2

Frappe HR version : 15.43.1

### Installation method

FrappeCloud

### Relevant log output / Stack trace / Full Error Message.

```shell

```

### Code of Conduct

- [x] I agree to follow this project's Code of Conduct

Please upvote the issue and also comment which proposal would be a better fix. Based on that, I will fix the issue