It is mandatory for Freight service providers to charge 5% IGST on SEA FREIGHT and 18% IGST on Air freight effective 01/10/2022

This IGST is irrespective of the Intra-state rule.

If supply of goods is our of India, it will be considered as Inter-State and IGST to be charged by the Freight provider.

The Issue

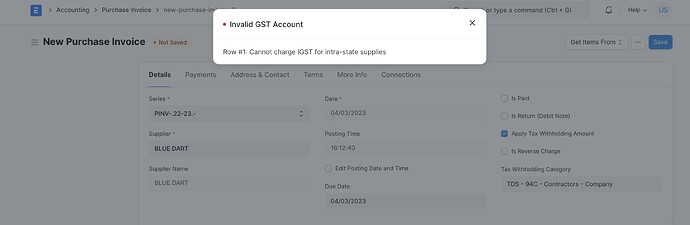

Ver14 has a check dis-allow posting of IGST for Intra-state Purchase Bills. (screenshot below)

Supplier = Bluedart (State code 09)

Buyer = Our company (State code 09)

Place of supply - International. Hence 18% IGST charged on Air Freight service rendered.

The problem

Purchase Invoice cannot be taken in account since checks dis-allow IGST.

please can we have a resolution for this, I assume the quickest method will be removal of the INTRA-STATE check which will resolve many of these issues