Hi Forum Members,

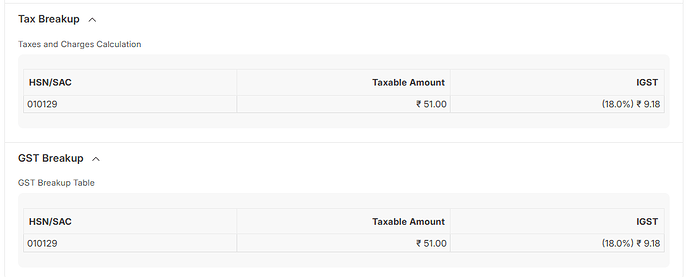

We have installed India compliance app to automate GST in our ERP Next. When I create a purchase order with item and its HSN code 010129, 18% is getting applied where its supposed to be 12% ( PFB below image for reference).

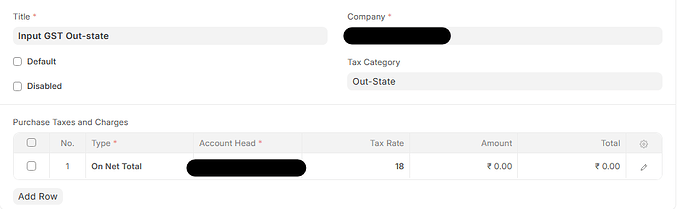

In the Purchase tax and charges template only rate mentioned is 18%.

If I change the percentage, same is getting applied to purchase order. But I want the rate to be added as per the HSN code mentioned in the Item. Please explain if anything wrong with my Tax and charges template set up.

Version Details:

ERPNext: v15.40.0 (version-15)

India Compliance: v15.13.5 (version-15)

Let me know if any further details are required to identify the issue. Thanks in advance!!

Hello,

You need to use the Item Wise Tax Template.

Taxes are fetched from the Item, not the HSN Code though you can update taxes from the HSN Code.

In sales transactions like Quotation, Sales Order, and Sales Invoice the taxes on items are calculated as per the Sales Taxes and Charges Template selected. However, if some items have an Item Tax Template linked, then the taxes are calculated on those items as per the rates mentioned in the Item Tax Template instead of the rates mentioned in the Sales Taxes and Charges Template.

Documentation Link: Item Tax Template

Hi Lakshit,

Since India compliance is installed, does this process not gets automated? I still need to map Item tax templates to items or HSN codes?

Changes to tax rates is difficult to maintain:

- This changes frequently and is difficult to track

- You may not wish to update your app as frequently

- One business on an average may use only a handful of HSN codes (for sales), tax rates for which may not be very difficult to update.

It could be undesirable if your tax rates suddenly change on an app update and affects your sales.

This implementation is intended to give end user more control.

Thank you Lakshit for clarifying how tax computed. I understood the process now.