Hello All,

I have a question regarding Deferred Revenue.

When we book an invoice with deferred revenue, how do we treat the VAT or Indirect Tax on the Invoice?

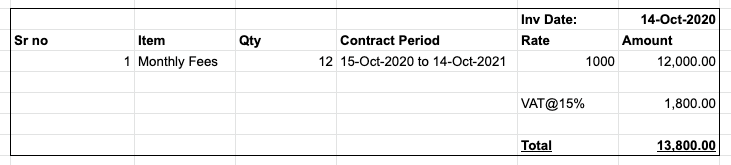

Let us consider an example of the below Invoice

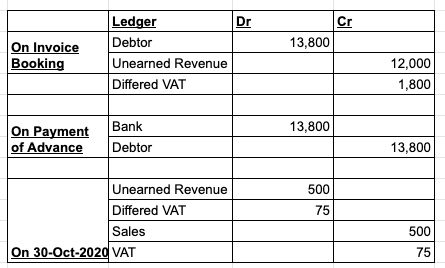

At the time of submission of this invoice (Invoice Booking) how will the VAT amount be treated? Do we book the full VAT amount in the VAT Ledger? I think that is wrong since we have not booked the full Sales, it is still an Unearned Revenue

According to me this what the entries should look like

Not sure if this is correct, would like to know what is the correct way to do so?

If the above way is correct, I don’t think this is currently possible in ERPNext.