On a self-hosted instance, I upgraded a site by restoring the database from v14 to a v15 server. Running bench migrate returns no errors.

When creating an invoice, all items have sales tax applied, even when the tax rule lists a specific item group. Item group is ignored in tax rule.

Any suggestions how to fix? Shall I file a bug report?

Ecommerce Integrations: v1.20.1 (main)

ERPNext: v15.32.1 (version-15)

Frappe Framework: v15.37.0 (version-15)

Frappe HR: v15.25.2 (version-15)

Payments: v0.0.1 (develop)

Well, it seems this bug is also present in V14. I’m not sure when it was introduced. I believe Tax Rules honored product groups sometime prior to ERPNext: v14.56.0 (version-14)

Can anyone elaborate on the Filters function in the Tax Rule?

Is the logic “OR” or “AND”. If I choose a product group and Tax Category do both have to be true or can either one be true for the rule to be applied?

I believe the answer to this question is the Filters only apply the appropriate template, they don’t filter individual items within the sales document.

With the help of @korecent_sapna I have a working model. Ignoring the “Item Group” in the Sales Taxes and Charges Template" we can override item prices at the item level or group level using Item Tax Templates.

There is a bit of work to get this working. For example in NYS there are over 80 tax jurisdictions. I already had a 1:1 record of Sales Taxes and Charges Templates (one for each jurisdiction). I had to create the same number of Item Tax Templates. For these, I assigned a rate of zero for the tax, since I want to make a group of tax-exempt items.

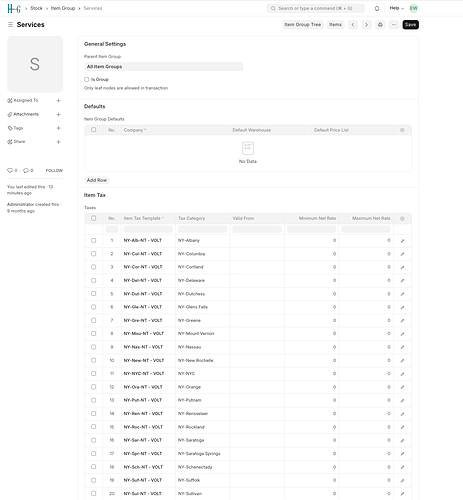

Then in the item group “Services” or “Non-Taxable” add the list of Item Tax Templates with the associated Tax Category for automatic assignment.

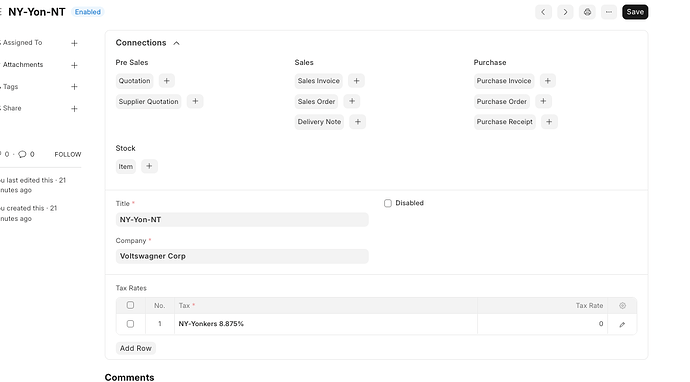

Example Item Tax Template:

Example Item Group to be used as tax-exempt: