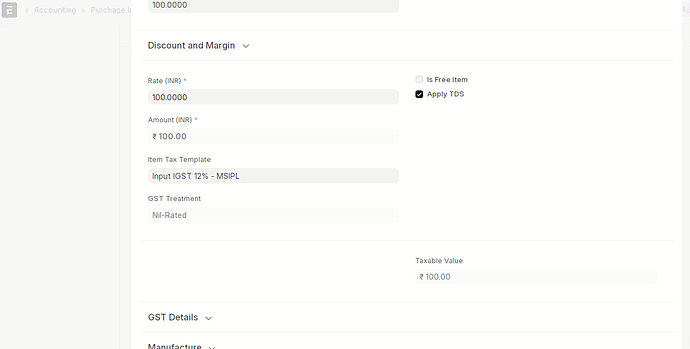

Added Item tax template to the Purchase invoice item. and its taking GST Treatment as Nil-rated after save.

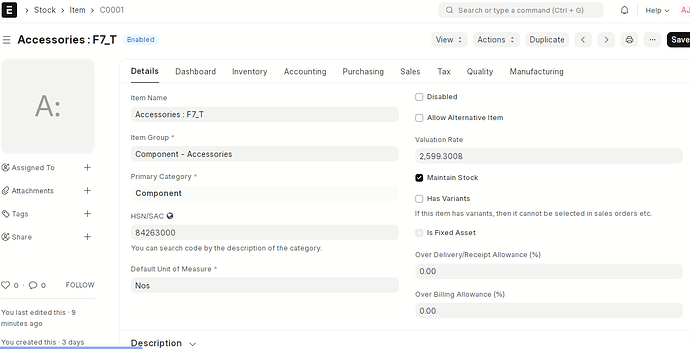

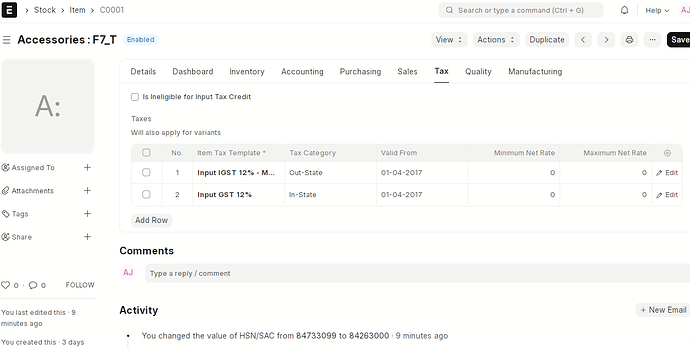

Item master set with HSN and tax templates as follow.

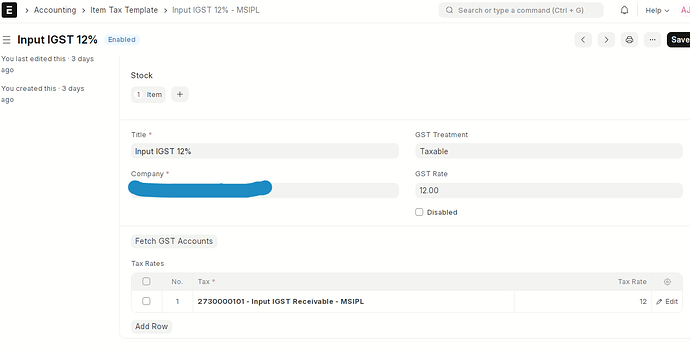

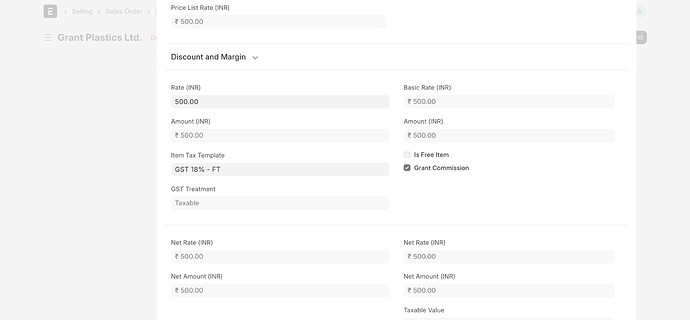

Item tax template master it has ‘Taxable’ to the GST Treatment.

why it is taking ‘Nil-rated’ in the transaction?

NCP

3

We checked in version 15,

It’s worked properly.

ERPNext: v15.12.0 (version-15)

Frappe Framework: v15.13.0 (version-15)

India Compliance: v15.5.1 (version-15)

Thank You!

But we get Nil-rated after save everytime.

is there any validation put on HSN code to the item. because now there is gst related check boxes removed now from item table.

- is nil rate

- is GST excempted.

NCP

5

Okay @poojavadher,

What version actually do you use in version 15?

And what is your HSN code? so I can try it from my end.

And

- is nil rate

- is GST excempted.

Both options is removed in latest version 15.

Thank You!

Hello,

There is no relation between the HSN Code and the Item Tax Template.

Can you please confirm the accounts used in the Purchase Invoice and the Accounts set in GST Settings?

If No GST Accounts are used in the taxes table, the Item is considered as NIl-Rated.

Regards,

Lakshit Jain

ERPNext: v15.11.0 (version-15)

Frappe Framework: v15.12.0 (version-15)

India Compliance: v15.5.1 (version-15)

I Disabled all purchase taxes and charges templates so taxes table remains blank after save the invoice and item is considered as Nil-rated.

Thank you

@Lakshit_Jain

@NCP