Hello,

I’ve been testing Landed Cost Vouchers and found problems in the way dollars are posted to the GL. In some cases liabilities are overstated, in others inventory is understated and I have not found a way to get around these problems so far.

I tested three scenarios, all for a $100 item, with a $10 shipping charge and a $15 third party charge. The $10 and $15 charges were posted to the “expenses included in valuation” account.

The $10 shipping charge was entered at different times during the three tests.

- added during purchase order entry

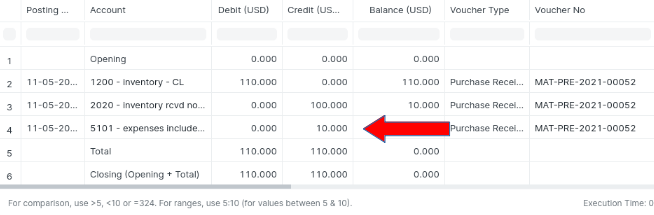

- added during purchase receipt entry

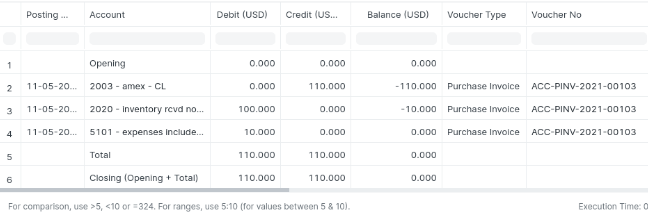

- added during purchase invoice entry

In all scenarios, the $15 third party charge was entered with a Landed Cost Voucher after purchase invoice entry. Below is the list of transactions entered for all three tests.

purchase order

purchase receipt

purchase invoice

landed cost voucher

shippers purchase invoice

sales invoice

delivery note

Tests 1 & 3 both overstated liabilities. Everything looked fine after the purchase invoice was submitted, but the LCV changed the $10 credit that had been posted to the “expenses included in valuation” account to the $15 LCV charge and a new credit for $10 was posted to the “inventory received not billed” account. Additionally, AP trade still showed a $110 credit, so your potential liability is now $120, when it should be $110.

When the LCV is submitted, if a new credit of $15 was posted to the “expenses included in valuation” account rather than “moving” the $10 credit to the “inventory received not billed” account, these postings would be fine.

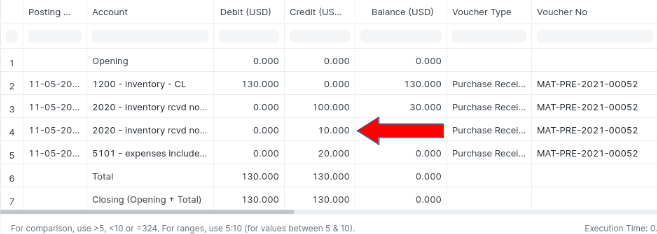

Test 2 understated inventory. The purchase receipt looked fine, but the $10 charge added to the purchase invoice did not hit the inventory account. It showed a debit of $100, but should have been $110. The LCV posted fine and debited the $15 to inventory, so it then showed a debit of $115, but should have been $125. The delivery note credited inventory the full $125, so inventory is now short $10.

If the purchase invoice posted a $10 credit, then a $10 debit to the “expenses included in valuation” account, then posted the $10 credit the inventory account, these postings would be fine.

Is there a correct way of adding landed costs to receipts that does not result in these problems?

I apologize for the long post.