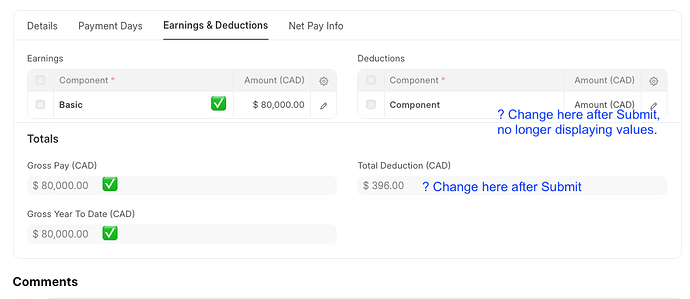

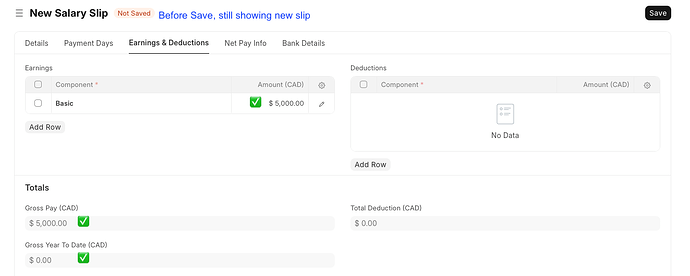

This is the first year using payroll. I thought I had everything figured out and working but I’m now seeing several issues. Any help is greatly appreciated.

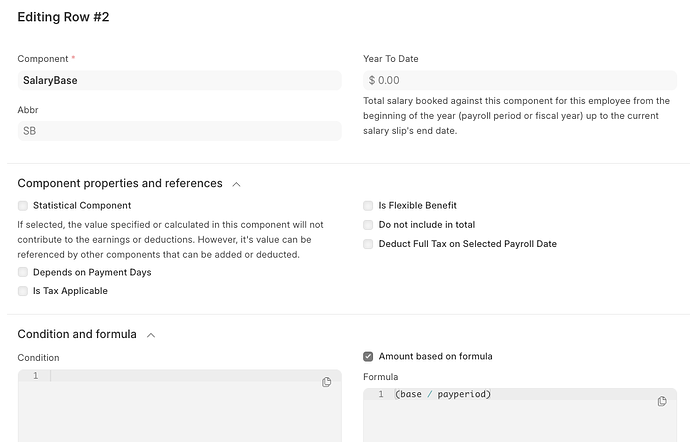

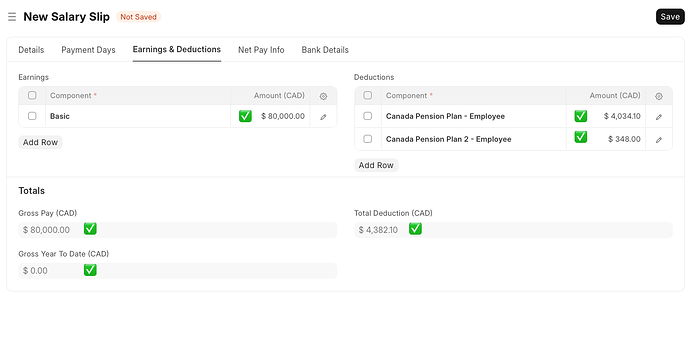

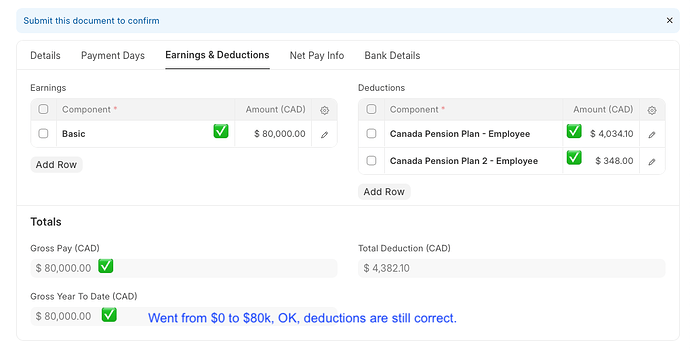

- When opening a Salary Structure assigned to an employee, with several pay periods already completed, the year_to_date field is zero for all components. Is this normal? I’m expecting to see $2,000 * 4 pay periods or $8,000.

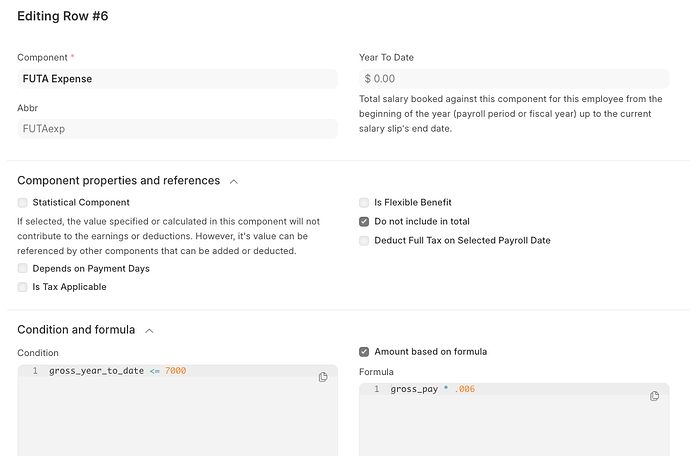

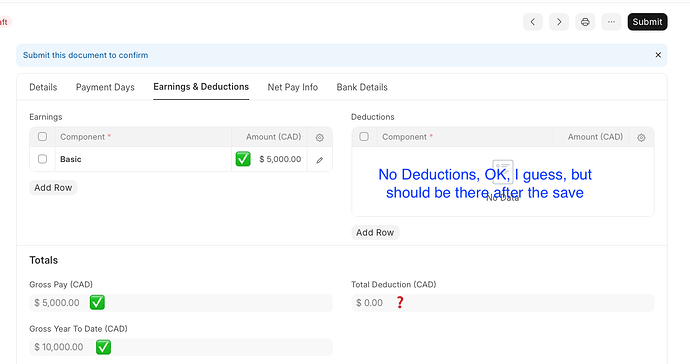

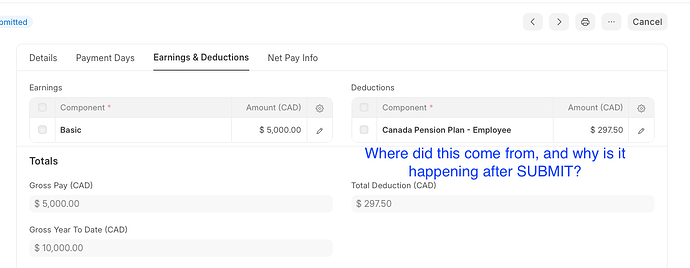

- It seems Condition statements are ignored, but perhaps the issue is related to the above missing YTD amount.

The following component is still being calculated even after ‘gross_year_to_date’ is $8,000.

My environment:

ERPNext: v15.58.2 (version-15)

Frappe Framework: v15.65.2 (version-15)

Frappe HR: v15.43.1 (version-15)

Montly payroll with one employee.

I’m using the built-in workflow (Create Payroll Entry, Submit, then Submit Salary Slips from Payroll Entry docType).

Salary slips and journal entries are correct.

Thanks in advance for looking.