Hello community, I need help understanding how to include a special tax, for the moment I can’t find a way of doing it with the system.

Brief summary: In our country El Salvador, alcoholic beverages are subject to 2 specific taxes:

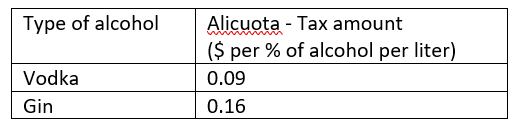

1)Alcoholic specific content tax (Alicuota) :** It’s a specific amount (not percentage) charged per each 1% of alcohol content per liter of alcoholic beverage. Each type of liquor has a particular tax amount per % of alcohol per litre of product.

Example of Alcoholic content tax table:

Example:

One bottle of 750 ml vodka 40% alc/vol is subject to:

[Alcohol %] x [Alicuota] x [volumen in liters]

40 x 0.09 x 0.75 = $2.70

2) Ad Valorem tax : The ad-valorem tax rate will be eight percent (8%).**

This rate will be applied to:

-

The suggested selling price to the public, declared by the producer or importer to the Tax administration.

-

The price differential, when alcoholic beverages are sold to the consumer at prices higher than those suggested to the public.

-

If item is sold below the suggested price to public the differential (8%) will be awarded as credit for the next month declaration.

From ERPNEXT point of view each item (Vodka, 40%, 750 ml) has specific details to correctly calculate the final tax and selling price.

| ITEM NAME | LUNA Basalto Vodka 750ml 40% |

|---|---|

| Product type | Vodka |

| % of alcohol | 40% |

| Volume | 750 ml |

| Alicuota | 0.16 |

| Suggested retail price (without any taxes) | 12.50 |

| Selling price (without any taxes) | (could be lower, equal or higher than suggested retail price) |

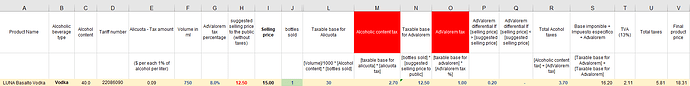

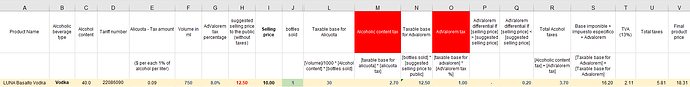

Complete calculation of alcoholic beverage tax:

- Case 1 (Selling price = Suggested retail price):

-

Case 2 (Selling price > Suggested retail price):

-

Case 3 (Selling price < Suggested retail price):