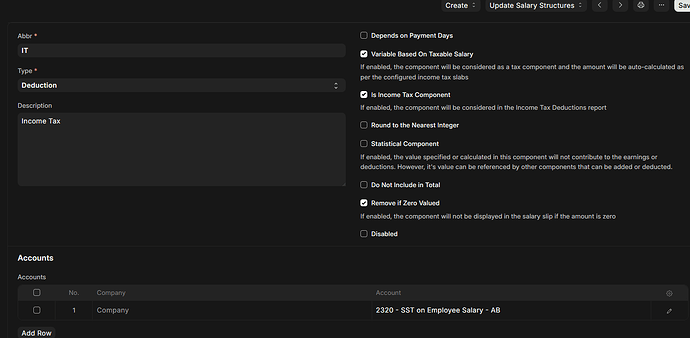

Currently, we have set Income tax slabs, salary components and all required setups for running payroll. Everything works fine. But we need a small change in account heads for income tax.

Current setting is:

Problem:

(imagine below situation)

Salary Gross yearly: 7 Lakh

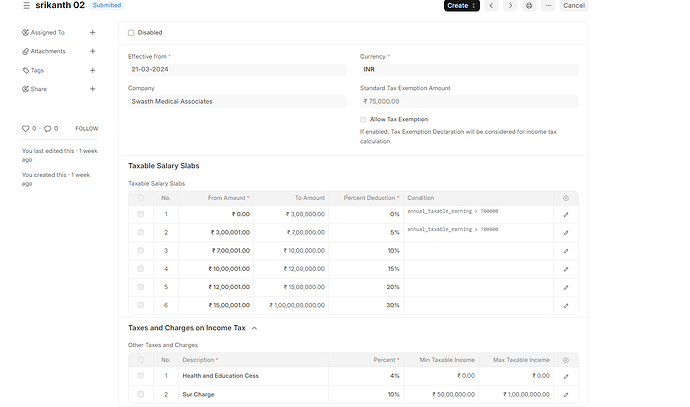

Taxation rule:

-

First 5 Lakh is taxed at 1% and booked under “Social Security Tax on Employee Salary” heading by the tax office. (we use 2320 account head as shown in above screenshot)

-

Next 2 lakh is taxed at 10% and booked under “TDS on Employee Salary”. (we created another account: 2330. It should be used.)

How can I setup the salary component/salary structure such that,

- for all employees getting under 5 lakh, tax will be booked under account head 2320 only @ 1%

- For all employees getting above 5 lakh, tax will be booked under two account heads such as:

a. under 2320: 1% of 5 lakh = 5000

b. under 2330: 10% of 2 lakh (if gross salary yearly is 7 lakh): 10% of 2 lakh = 20,000

Total tax = 25,000.