i need some help with this…i entered stock through stock entry via material receipt …But there is this stock adjustment which is reducing cost of goods sold…what is the effect of this and how do i handle it?.

More details plz to could help you

when entering stock through material receipt, there is a difference account , in the difference account there is stock adjustment which is a stock expense and reduces cost of goods sold which increases profit.

Why you use material receipt To increase your stock

What about purchasing or manufacturing.

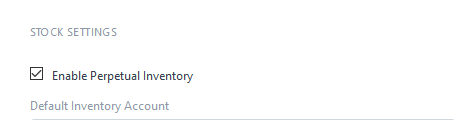

You’re using the Perpetual Inventory method, in that cost of goods sold means your stock expences.

If you want to use periodic inventory disable the Perpetual Inventory under accounts → Company → Stock Settings

yeah, it was a mistake done instead of using purchasing, it was done through stock entry via material receipt , the stock has not yet been accounted for.

disabling perpetual inventory will affect over the counter sales , i don’t thick disabling the perpetual inventory will have an effect to stock adjustment since it relates to stock entered in stock entry via material receipt

Could you share screen to this transaction

i think the system should be upgraded to enable payment of stock in material receipt which reduce the stock adjustment since it is a stock expense account whereby debit stock adjustment and credit cash/bank… the previous update of purchase invoice in material receipt has no effect on stock adjustment.

which version you’re using. Basically material receipt will be create against the purchase invoice

Am using version 11…there is that option of purchase invoice in material receipt but it has no effect to the stock adjustment …also you cannot directly link the purchase invoice created to the specific material receipt…