Hello RSA,

is it possible to introduce me this developer to implement the same for me?

It is a German company - if this is okay for you?

I think its works for me.i will have a chat with them.

Thanks for your help.

Hi Henry,

i just installed your app and try to figure out how to get all the “down payments” for the final invoice together! When i create 2 “Down Payment Invoices” and then want to list the down payments in the final invoice withe the “Get Down Payments” Button it is giving me the following error:

"exception": "TypeError: get_party_account() got an unexpected keyword argument 'include_advance'"

Any idea why and how i can solve this?

Great idea, so far.

Hi @Nico

How do you install the app ? From bench install-app or from Frappecloud MarketPlace on FC instance ?

What is your ERPNext version ?

Version of the ERPNext France ?

Another App installed ?

I’ve check the code and I think I found the code line responsible, but the error message you copy past tell me you’r on ERPNext version 14 and ERPNext France (from version-15) branch is only ERPNext version 15

By the way I’ve just realize, thank’s to you, that our version number of ERPNext France App was always 0.1.0 whatever the github branch. I’ve just updated the github repository and ask new realse on frappecloud marketplace

If you are on ERPNext 15 could you please rise an Issue on Github with all the detail (and the complete error log, on error popup you should have Copy error in clipboard) that allow us to reproduce ?

Hi @FHenry

The app is installed via bench as described in the git repo.

These are the installed versions.

erpnext 14.70.3

erpnext_datev 14.2.0

erpnext_france 0.1.0

erpnext_germany 14.6.1

frappe 14.76.0

hrms 14.28.3

payments 0.0.1

I thought it interferes with “erpnext_germany” app. It tried to isolated the “down payment” feature/function , but haven’t come far yet.

Thanks for your quick reply. I appreciated every hint you can offer.

I have just realized that i indeed installed the wrong version of your app. I will check it tonight.

many thanks ![]()

Nico

Hi @FHenry

I just installed version-14, but unfortunately the deposit function is not working. Don’t see any custom fields regarding deposit payment created. Do you know if you erpnext_france app interferes with the erpnext_germany app.

For example if i want to add an ‘deposit item/down payment item’ there is no check box/select box within the new item creation process.

I really appreciated any help.

Thanks

Nico

Hi

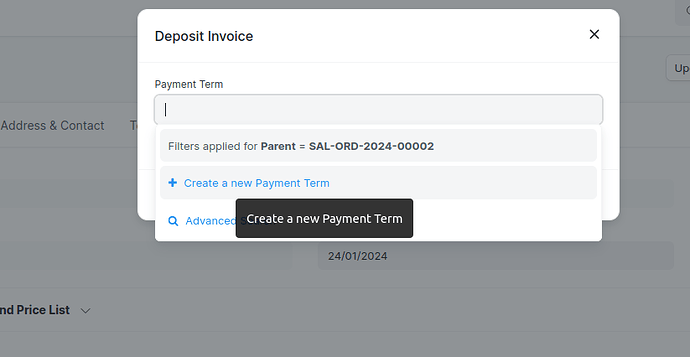

In version 14 it work like that

On validated order

Select or create payment terms

And normally the invoice create have checkbox with “Is Deposit invoice” and all Items (rows/lines) from the source Sales Order comes with the quantity change as the % as the Payment Term.

On my test environment it no not work anymore because I broke it.

The problem with this way is, if your UOM of Sales Invoice Item have to be integer, it do not work anymore…

In version 15, it’s a different implementation.

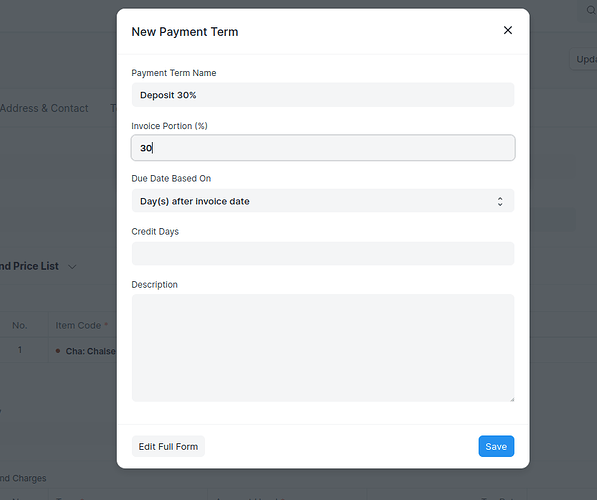

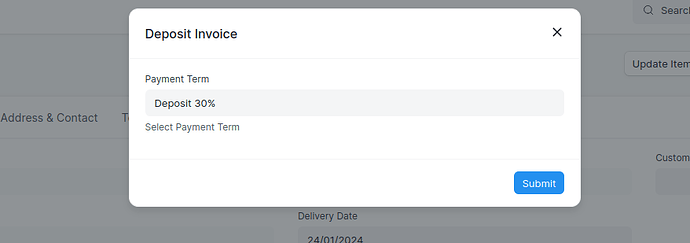

Create an item with checkbox “Is Deposit”, input % of deposit

From Sales Order, create Deposit invoice, it will result only one Sales Invoice Item (row/line) with the Item Deposit Item and the % apply from Sales Order Total amount. We inspire from how ERPNext french hard fork do (I would not give name here, it not hard to find), and decide it’s better integration.

The actual limit, when creating a “deposit” Sales Invoice, ERPNext will take the “first” (first created in fact) Item “Is Deposit”, you cannot choose one if you had 20%, 30%, 40%, it will apply the “first”, and apply the % of this item.

It’s not perfect, but that cover our customer need for the moment. We will work in the future on better implementation, if our customer need it (and finance the development)

In both implementation. It’s deposit payment that you can retrieve in Advance Payment on “final” Sales Invoice. From there it’s like ERPNext do with “Advances” Payment on Sales Order (but without issuing invoices and that’s the problem in France. Payment Request on Sales Order aren’t Sales Invoice)

I check (only by reading code) if erpnext_france interferes badly with erpnext_germany, it seems not, but eventually you’ll have two way to check VAT number from EU API Service ![]()

Works like charm, thanks a lot for sharing.

The integer is indeed needed.

I also like the version 15 intergration better, I need to ugprade ![]()

Thanks a lot

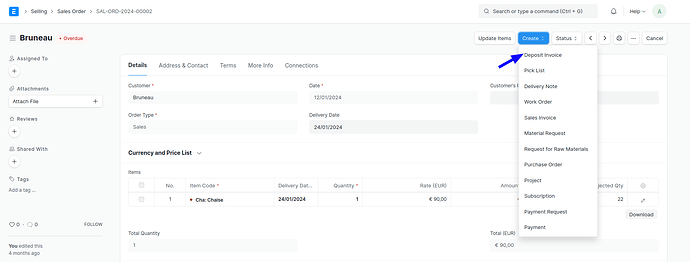

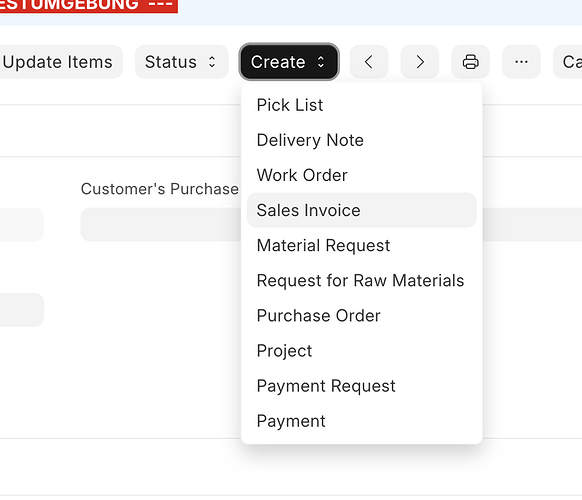

Since my last update, i don’t see the “Deposit Invoice” option in the Sales Order “create” drop down anymore.

Any help is appreciated, i just spend the entire day to figure out what happend. I have installed the erpenext_france app multiple times, disabled all cleint/custom scripts…

Thanks

erpnext 15.53.1

erpnext_datev 15.2.2

erpnext_france 15.0.2

erpnext_germany 15.13.0

frappe 15.56.1

hrms 16.0.0-dev

payments 0.0.1

Hi @Nico

As I explin in previous post the process is implemented differently in erpnext_france version 15

I’ve also documented it here "Deposit Invoice" Button disappeared after ERPNext version upgrade · Issue #3 · scopen-coop/erpnext_france · GitHub

If you need some complementary services for this app do not hesitate to contact us

@FHenry thanks for your solution. This is also the same for our case where we need to issue invoice with deposit amout + tax.

Indeed, this featre should be included in ERPNext standard.

Hi @FHenry,

i just noticed that my previous reply to you somehow didn’t get published.

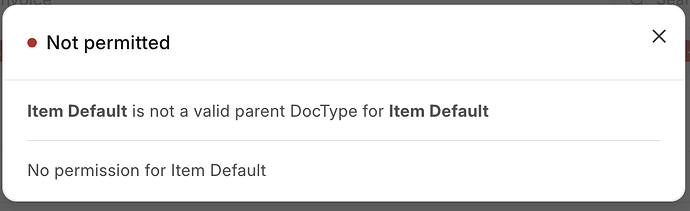

Thanks for the quick response and explanation. I works just as explained. We only get the message if a none admin User is trying to check the “Is Deposit Invoice” check box that says:

Many thanks

Nico

@kittiu Actually we are continuing our work in ERNext France with the lastest published feature (on Github version-15 (on FrappeCloud the process to push a new version is not automated for now) to manage “Eco Tax” probably only applicable in french market (may be european).

The Deposit Invoice is a really huge topic, we are working to relate it with Payment Terms Template from Quotation to Sales Invoice.

In France, the total without tax (let’s call it Total HT) of Deposit Invoice should not be include in the accountable turnover (let’s call it CA) of the company in a Fiscal Year (according invoice validation date), but the VAT reporting (monthly/per 3 month or Fiscal Yearly, depending of company choice) must include it.

The Total HT will be part of CA when the final invoice will be validated only.

This can be manage by affecting dedicated account code to the item use in Deposit Invoice.

I use “turnover”,“total without tax” words because it’s the most acceptable translation, but it’s not always the same definition regarding local accounting law specificiation.

Actually on a Quotation when you add Payment Terms Template the payment date is be calculated on “Invoice date”… Heuuu, I’m on Quotation why Payment Terms (from Payment Term Template) should bother me with invoice date… I don’t know.

And worst when you create a Sales Orders from a validated Quotation the Payments Terms date are copied witch result to error message on validation of Sales Oorder (somthing like “date of payment could not be before date of document”…), this make no sense to final users. We are working on it (Payment Terms before Invoice)

Our final goal will be, by an exemple

On Customer Doctype

- Existing field

- Default Payment term template

- Template : “30 days”

- Payment terms : 30 days (calculated base of Date of Invoice)

- New field

- Default Payment term before Sales Invoice

- Template: "30% validation/70% shipping"

- Payment terms : "30% validation" (Rule: will be calculated base of Date of **Document** (Quotation or Sales Order)))

- Payment terms : "70% shipping" (Rule: calculated base of Date of **Shipping** (for Sales Order)))

When create Sales Order from Quotation the dates of Payment Terms will be recalculated by the rules define “30% validation/70% shipping”

In this Sales Ooder we have 100€ of VAT 10% and 50€ of VAT 20%

In Validated Sales Oorder, add an action in the button “Create Deposit Invoice”

=> popup auto fill with 30% (as of 1st Payment Terms)

=> Create Sales invoice (Mark/Check as Deposit with auto pre-select Series…)

- 1 item/line and in the description “Deposit Invoice of X % for Quotation/Sales Order name”

- Taxes

- VTA 10%, amount : 30€ (30% of 100€ of VAT 10%)

- VTA 20%, amount : 15€ (30% of 50€ of VAT 20%)

On “Final” Sales Invoice created from Sales Order, Default Payment Term template is 30 days (calculated base of Date of Invoice) that’s OK

Here allow to get Previous Payment but this will

- add negative line that will reduce the Total HT amount base on previous Deposit invoice payed related (not an minus on payment due, but an Total HT deducted because the VAT calculation is base on HT and we already collected the VAT on the Deposit Invoice)

Actually the standard process deduct the amount due, that not what we want in france.

Well that the goal, if you want to provide contribut feel free.

@FHenry thanks for the reply. We are looking into the code, following version-15. But in fact, our requirement will be in Purchase Deposit, so I think we can contribute somehow.

WIll you consider make it a separated module, we can go in and work from there. Otherewise, we are also planning to include this feature into our localization (erpnext_thailand). But I do understand if you keep it in France localization.

By the way, I just notice that your Deposit account setting is in Revenue (4xxx), and not in LIability (2xxx)? Because it is set in Item’s Income Account, may be?

FYI @rmehta I read that you are asking what feature is missing in linkedin. I think this is one significant feature ![]()

Will you consider make it a separated module, we can go in and work from there. Otherewise, we are also planning to include this feature into our localization (erpnext_thailand). But I do understand if you keep it in France localization.

Actually we plan to do it inside erpnext_france, if you want to contribute, that’s warmly welcome. But feel free to just get it (copy/paste) into Thailand localization.

I would like to offer a better solution than copy/past, but here we will be confronted to limit of “priority hook while list method” customization.

By the way, I just notice that your Deposit account setting is in Revenue (4xxx), and not in LIability (2xxx)? Because it is set in Item’s Income Account, may be?

Yep, that’s it, in French (Latin) accountancy the Root Type “Revenue” or “LIability” have no match, there are Types : “Expense”, “Income”, “Thirdparty” and others but I won’t details here (really not related to “Root”; that a major point about port/use accountancy in ERPNext for European accountancy).

Amounts from Deposit Invoice or amount send for Purchase Deposit are in code 4xx (Type “Thirdparty”)…

Let’s see what will coming in future release ![]()

Is there a GitHub issue for this? hard to keep track of issues on the forum

@FHenry I have created Thailand version of Deposit. I would say thank you! as your version also gave me some idea how to proceed.

I mostly redo it anew as I think it might not be exactly the same with France Localization. This is the version I think mostly fit with our experiences here in Thailand (so I put it in Thailand Localization).

Thanks again!