Hello,

I’m in need help to understand the right way to use tha Tax and Charges on Payment Entries, as I can’t find it in the documentation.

This is an example of my scenario:

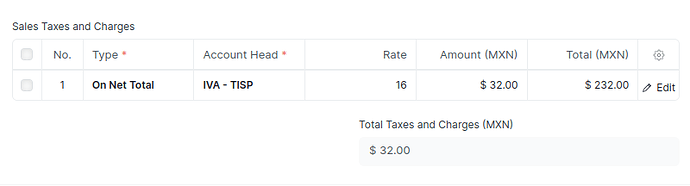

First, I’ve created a Sales Invoice with the corresponding taxes for my country.

200.00 + 32.00 of sales taxes

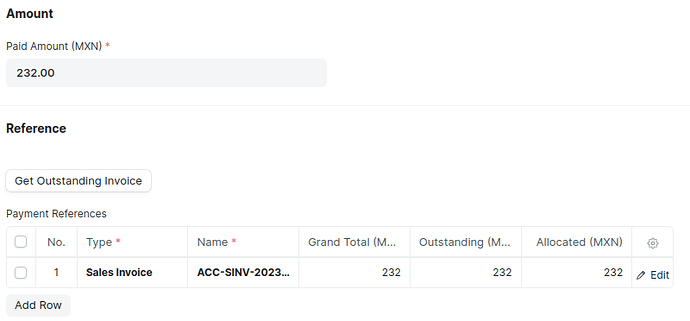

For that invoice, I’m creating a Payment Entry, for the total amount of 232.00 (net total + taxes as per the previous image)

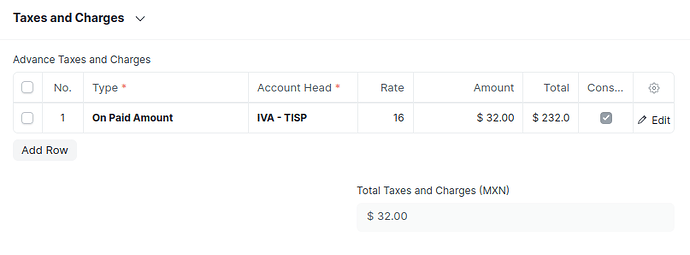

For that Payment Entry, I’m adding the sales tax and ticking the “Considered in Paid Amount option”. This considers the 32.00 as being taxes

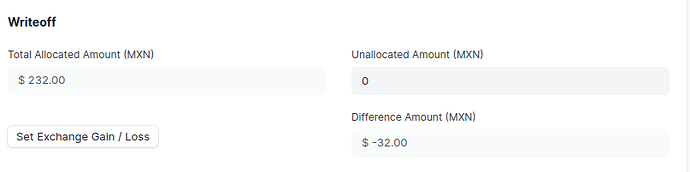

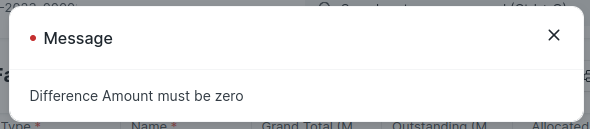

This last step, leaves me with a Writeoff difference of -32.00, so I can’t submit the Payment Entry until I leave the difference on 0

So my question is, how can I add to the payment entry the detail of those taxes without affecting the Difference Amount? I’ve already tried adding to the entry some Payment Deductions or Loss lines, but it just adds to the difference instead of removing it.

Or is it a bug?